So you’ve made too much money and you’re trying to find a way to lose it all with stock derivatives. And somewhere in your degenerate gambling journey, you’ve stumbled upon people talking about “puts options.” But what are put options?

In this post, I’ll go through:

- Risk profile of buying put options

- What are put options

- And some real (losing) trades I’ve done with puts.

Table Of Contents

Risk Profile Of Puts

I talk about risk profiles first before I even talk what put options are because this is the most important part.

Just know that when you buy put options, here’s your risk profile:

- Limited downside: You cannot lose more than what you put in. Your max loss is the money you used to purchase the put options.

- Limited upside: Puts are on the “short” side of the market. Hence, you’ll maximize your profits when the stock goes to $0.

Note that even though puts are on the “short” side of the market that the risk profile here is better than shorting. Unlike shorts, puts have a limited loss. If you were to short shares directly, you can have an unlimited loss.

What Are Put Options? A Basic Definition

Puts are very similar to call options, except they’re on the opposite side of the market.

You’re purchasing the right, but not the obligation, to short shares in a particular stock. Like calls, there are 2 main variables in a put options contract:

- The strike price: the price at which you’ll be shorting the stock at.

- Expiry date: the latest you can exercise the option to short the stock.

Like all options contracts, each put option is representative of 100 shares. For example, 1 put option grants you the right to short 100 shares at the strike price, before the expiry date. Thus, you must make options bets in units of 100 shares.

I’ll highlight some concrete examples below so you can see all the numbers involved in real trades.

An Example Of What A Put Contract Looks Like

The market looks quite soft and I believe TQQQ will crash. This is due to Evergrande getting wrecked in China.

Therefore, I’d like to purchase some “out-of-the-money” (OTM) put options. OTM in a put just means that I’d be buying a put option with a strike price below the underlying stock’s price. This means if my OTM put were to expire today, my contract would be worthless. This is because no one would borrow shares to short at a lower price than the market rate.

- “In-the-money” (ITM) contracts are opposite – if ITMs expired today, they’d still have some intrinsic value to them.

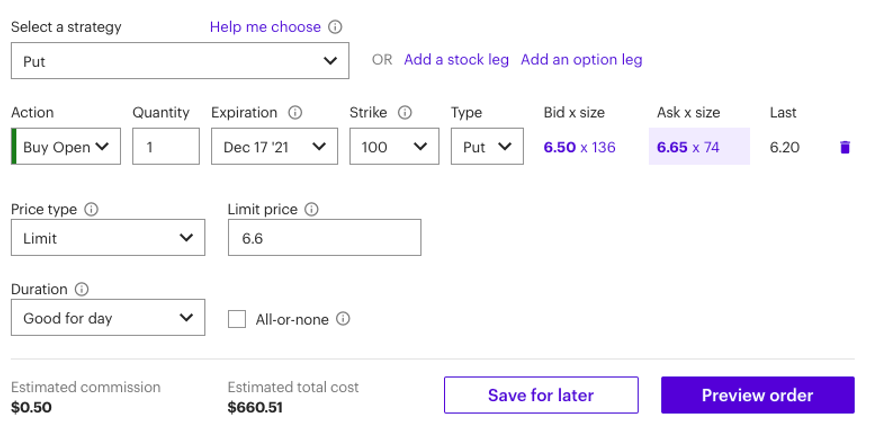

Anyway, TQQQ today is at $127.83. So let’s take a look at an example to see what a put option looks like if it expires on Dec 17, with a strike of $100. Here’s what it looks like:

Each share has a bid-ask of $6.5-$6.65. If I set a limit price of $6.6, I’d be paying $6.6/share. Because the “Quantity” of the contract is 1, I’m actually buying the right to short 100 shares. Hence, the Estimated total cost is $660.

- If I were to do “Quantity” as 10, it gives me to right to short 1000 shares, meaning my cost would be $6600 instead.

An Example Of A Major Losing Trade I Did

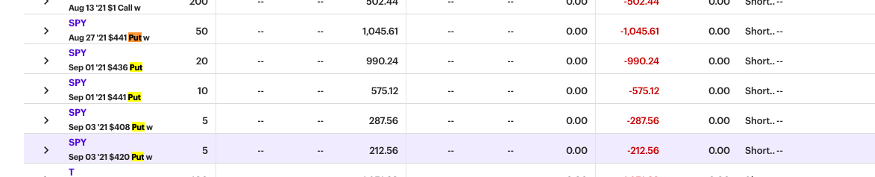

Below is an example of a losing trade I did with puts. I tried to buy puts on SPY during the Jackson Hole meeting.

Jerome Powell did his usual talk of “we’ll print money forever and inflation is physically impossible.”

Stocks skyrocketed.

Here are my trades, and losses, explained.

- I bought 5 different put contracts.

- 50 puts expiring at August 27th, 2021, at a $441 strike. Every dollar underneath $441 prior to 8/27/21 yields a profit of $5K.

- 20 puts at 9/1/21 at $436 means that every dollar underneath $436 prior to Sept 1, 2021 yields a profit of $2K.

- And so on.

- As you can see, my total number of contracts is 50+20+10+5+5 = 90. This is about 9000 shares that’s involved here.

- Unfortunately, all of them expired OTM (AKA worthless) and I lost ~$3110 (100% of my capital).

- Losing $3110 for 9000 shares isn’t too bad if you think about it in the grand scheme of things. This is the “upside” of the risk model: your losses are limited.

- The downside of the risk model is most of your options trades can result in a total loss, like this one.

My mistake is that my options, on the aggregate, rose 30%. But I was too greedy and didn’t sell because I thought the market would tank. It reverted and went way up. Ergo my puts are worthless since the chance for any of my contracts to land ITM is gone.

An Example Of A Minor Winning Trade I Did

Here’s an example I succeeded when I bought puts:

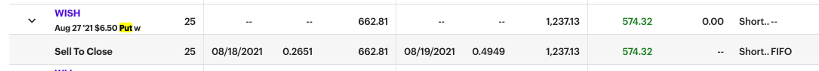

WallStreetBets was talking about how WISH would go up. There was no real basis for this. And so I just did the reverse-WSB trade and bought puts.

In this case, my puts position started out at 2500 * .2651 a piece. The next day, they were worth .4949 a piece. So I earned about $574.

- I use a 2500 multiplier instead of a 25 multiplier, because remember each contract is representative of 100 shares. And the “.2651” is the price per share.

- I repeat this because this is one of the more confusing parts of options trading is that things are often off by a factor of 100.

Anyway, I made almost 88% in a day here but I’m still down. Way down.

Which leads us to the next question.

Should I Buy Put Options?

No. I wouldn’t do it if I were you. Here’s the reason. You’ll need to:

- Predict whether or not the price will fall.

- Predict how much it’ll fall.

- Predict the latest date by which this’ll happen.

Predicting even one of these is extremely difficult, let alone all 3.

This is the same difficulty as predicting call options. But there’s one more caveat with puts. The market skews towards going up and your upside is limited, unlike calls. So it’s like you’re already doing something very difficult, and you’re going against the market. And your upside is limited when compared to call options.

Buying puts isn’t “swimming against the current” – it’s like trying to swim up a waterfall. You can try, but you probably won’t succeed.

- If you insist on gambling, consider call options instead where the downside risk is the same but there’s no limit to your upside.

If reading this short piece you’re ready to gamble away your life savings, here’s my E-Trade affiliate link here. Signing up will give me something – but I forget what.

Or, don’t incinerate money by buying the S&P 500 Or something.

0 Comments

Trackbacks/Pingbacks