In this post, I talk about where you should invest your money if you’re in the USA. These strategies are based upon minimizing risk and maximizing your tax-efficiency. Read more below to know the order in which you should save up and invest your money!

Table Of Contents

Where To “Invest” Your Money First: Emergency Funds

Where you should first “invest” your money is towards a rainy day fund. The reason for this is that we want to secure our downside protection first and foremost.

You’re unlikely to make a ton of money overnight in the market. Thus, in the grand scheme of things, delaying putting your money in the market until your emergency funds are in place doesn’t really make a huge difference. As an example:

- Say it takes you 6 months to save up enough in your emergency funds before putting your money in the market.

- Your investing journey will last 30+ years.

- The 6 months doesn’t really matter.

Also, shoving money into your 401K won’t matter if you need to call upon it as an emergency fund. At best, you’re paying an interest rate (back to yourself, but that’s besides the point) if you borrow against it for emergency funds. And the borrowing is only up to 50K. Suppose you’re in a traditional IRA or something, withdrawing from those funds = you take a massive penalty. In these cases, you’re taking a huge penalty merely because you didn’t save enough cash for emergencies. Better to keep some requisite amount in cash for unexpected emergencies.

Don’t expect emergencies? Good! That’s why they’re emergencies – they’re unexpected by nature.

How much should you put in your emergency fund? Ultimately, it’s up to you but I’ve an article on a few ways to think about how much to allocate to your rainy day fund here.

Next, Pay Off High Interest Loans

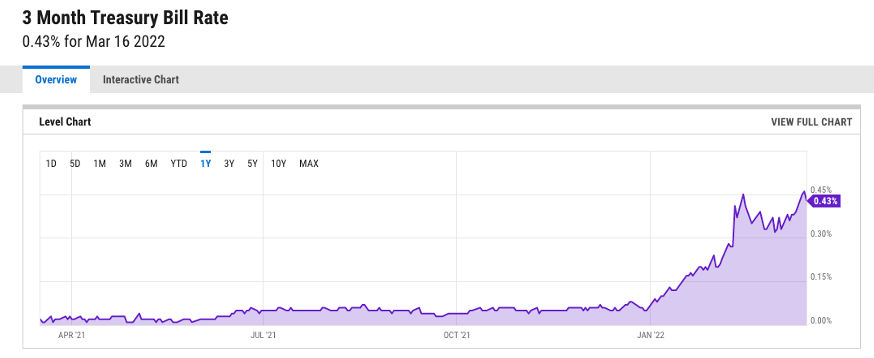

What are high-interest loans? These are loans that are around +5% of risk-free return. Other words, +5% of a 3-month Tbill yield. As an example, as of this writing, the 3 month Tbill rate is 0.43%:

Thus, if you’ve loans with interest rates of 5.43%+, you should pay them off.

The reason for this is simple. As “investments” compound, as do debt. Paying off high-interest rate debts is both:

- Downside protection. More principal paydown means less expenses in the future. AND

- A guaranteed return. Paying off these bills is equivalent to +5% guaranteed return for you. After tax.

The ROI on paying off high-interest rates loans is simply too tempting to pass up. The 5% is just a ballpark estimate. The percentage you should choose should be based on whether or not you think you can guarantee yourself a higher gain than X%. If you think you can always get more than a 8% yield in the market, for example, then you should pay off loans that are +8% of risk-free rate. If you think you can always get more than a 3% yield in the market, then pay off any loans that are above +3% from the risk-free rate. Hint: The latter is more realistic.

Third Place Where You Should Invest Your Money: HSAs

Next place to invest your money: Health Savings Account (HSAs).

Whereas an emergency fund will protect you against:

- Loss of a job

- Health emergencies (that your Health Savings Account can’t cover)

- And any other emergencies

Your health savings account will only you from the downside for health emergencies. But why’s it so important to fill up your HSA to the brim? The reason’s because health expenses (in the USA) are ridiculous. It’s one of the highest potential downside exposures you have if you live in the states.

Say you get laid off: you just really need to pay for rent and food. This can be expensive, for sure, but it’s very easy to calculate what you need to save up for just surviving.

But suppose you go to see a doctor in a high-deductible account? $500.

Or maybe you need some blood tests done? $250.

Need an MRI? $800.

And these itemized things come in groups. It’s not like you’ll go to a doctor and they only charge you for one highly-inflated medical expense: it’s generally many things that they charge you for.

Because health expenses can be extremely expensive (cancer treatments are 6-figures, as an example) – you should definitely max out your HSA every single year. Especially if you’re older and the probability of you incurring a 6-figure+ medical bill climbs higher every single year.

To summarize why HSAs are ridiculous great:

- Your deposits into your health savings account are pre-tax.

- All withdrawals from the account for medical uses are NOT taxed (huge downside protection). This means you can pay your medical bills with pre-tax money. This is a ridiculously high return. Consider you’re a highly paid person in NY or something – this is an instant 43% return.

- Unless you live in California, trading in your HSA to grow your money will not be taxed. And your HSA net worth can grow tax free.

- You can use the money as normal post-retirement, and it’ll be taxed as regular income (behaves like a traditional IRA).

TL;DR, you could get up to a 43% bargain on medical bills if you take into account the tax advantage that a health savings account provides. Thus, this is a place where you should definitely invest your money before doing anything fancy with your money.

Then, Fund Your Retirement Accounts

Now we’ve got the unsexy stuff out of the way, let’s do more unsexy things.

Not all companies have a 401(K), but those that do generally have a match. You should fund your 401(K) up to your company match, because it’s free money. If your company doesn’t match, then a 401(K) isn’t as attractive because:

- A traditional IRA would have the same behavior: pre-tax income contribution (contributions are deductible on your income), and post-tax withdrawal (you get charged ordinary income tax when you withdraw) in retirement. The main differences are traditional IRAs give you more options and less fees than 401(K). And the other difference is that the pre-tax contribution limit is $6K and 401(K) is $20.5K (for single people, as of 2022).

- Thus, you should throw enough money to get maximum company match for the free money, and then toss the rest to a traditional IRA (or if you want, you can throw more in the 401(K)), if you’re not eligible for a Roth IRA.

Next, I’ll hone in on this Roth IRA. And I’ll separate it for 2 groups: people who are eligible to put money in the Roth IRA, and people who make too much money to contribute directly to the Roth IRA.

If you are eligible for Roth IRA, then you should throw your money in there next, because while deposits are after-tax, all withdrawals are post-tax. This is a huge return (refer to the 43% example above to see why), especially if you can compound that money over time.

If you make too much money and can’t directly invest in the Roth IRA, there’s 2 channels for you to toss money into your Roth IRA:

- Traditional backdoor: This is the process of putting money into a traditional IRA, and then rolling it into a Roth IRA. Sounds complicated, but doing this is very simple and only requires a few clicks on sites like Vanguard, etc. So for example, you’d put $6K into a traditional IRA and then convert that into a Roth IRA each year. It is important to note that under the Biden administration, this could be deprecated after 2022.

- Mega backdoor: This is the process of contributing the maximum amount to your 401K, which is 61K. As an example, you can put in 61K into your 401(K), of which the first $20,500 is tax-deductible. The other $40,500 will be after-tax money. However, this $40,500 can be rolled over into a Roth IRA. If your company’s 401(K) allows for this, this should be in your benefits portal and also only requires a few clicks to do so. This method is also under attack under the Biden administration. Luckily, it seems like it’ll be deprecated in 2029 at the soonest.

Thus, in theory, if you’re a high earner in 2022, you can toss in $40,500 + $6000 into your Roth IRA each year (or about $46.5K). Not bad at all. Considering after 5 years, you can withdraw the principal if you’d like.

Last Place On Where To Invest Your Money

The last place on where to invest your money is also the most common. And this is simply investing in things like stocks and bonds with a regular, taxable account. Though I recommend investing in platforms like Vanguard, E-Trade, or TD-Ameritrade. And I’d avoid brokerages like Robinhood. The reason’s because while the latter is “easy” to use, it also exposes you to frontrunning by Wall Street, in which every single one of your trades is more expensive than you’d otherwise had paid for it. In other words, if you don’t take precautions I talk about here, you’ll lose money on every trade.

Even though this is the ‘last place’ to put your money, it’s a very important place. And after-tax investing is a crucially important tool for anyone to grow wealth.

Learn how you can do this responsibly, safely, and automatically by signing up for our 3-Day “Save Your Way To Wealth” tutorial below. You’ll get an email each day, for 3 days, showing you exactly how to automate your way to saving money and saving your way to wealth. No BS, and no spam.

In Conclusion

This post talked about the order of where you should put your money. Messing up the order can be detrimental, since you might allocate too much to something that yields a lower return, leaving not enough to invest in something that could have given you a higher return. In short, you should approach your order of investments like so:

- First, invest your money in something that gives you the highest downside protection.

- Then, invest your money in the most tax-advantaged accounts you can.

- Finally, invest your money into an after-tax brokerage (that doesn’t sell your data and let Wall Street frontrun you).

0 Comments