“Financial independence, retire early” AKA FIRE, is a movement where people realize they don’t necessarily have to work until 65. In this post, I’ll explain some high level strategies on how you can retire early and reach financial independence, as well as how much money you’ll need to actually “FIRE”.

Table Of Contents

3 Types Of Financial Independence/Retire Early Strategies

There are 3 different FIRE profiles.

- LeanFIRE: This financial independence/retire early strategy means you really want to quit ASAP. You’ll save up some requisite amount of money, and that money will spit out some dividends each year for you to spend. And you’ll be much more frugal than everyone else. But the tradeoff is you don’t have to work nearly as long as the other 2 strategies.

- FatFIRE: This FIRE strategy means you’ll save up so much money that you could, in perpetuity, live a lifestyle of luxury even if you retired early.

- CoastFIRE: This FIRE strategy doesn’t actually involve “retire early” – so I don’t know why it is called “CoastFIRE”. You simply save up enough money so you can retire at X age. Once you’ve reached this status, you can just ‘coast’ by simply living “at your means” and don’t need to save any extra money. This is because by the time you reach age X, you’ve already a big enough nest egg to last you forever.

Different FIRE strategies require different amounts of work, effort, and time. Example:

- LeanFIRE can be achieved just through some conservative investing and saving strategies. As can CoastFIRE, depending on the age you want to save up for.

- FatFIRE requires suffering through enormous amounts of entrepreneurial pain, and you likely need some specialized skill or do a business in which you generate tons of money.

While the specific tactics vary wildly depending on which goal you have, the over-arching strategy is the same:

- Save as much money as possible.

- Invest as much money as possible.

- If FatFIRE: Earn as much money as possible also.

For non-FatFIRE wealth, subscribe to the below 3-day tutorial to find out how to automate your savings and investments so your route to retirement is 100% passive.

How Much Do You Need In Order To FIRE?

Regardless of the type of financial independence/retire early strategy you’re using, you need some requisite amount of money before retiring.

In the FIRE community, this amount of savings is often expressed as a multiplier for your yearly expenses. For example, if you want to adhere to the famous ‘4% rule’—or the rule that you’ll withdraw 4% of your net worth in perpetuity—you’ll want 25X annual expense as your liquid net worth.

Since this “4% rule” is so famous, let’s run some simulations on it to see if it’s even something feasible.

The 4% rule is made famous by the Trinity Study, which is just a study of how much money you could withdraw from your account without ever running out of money. One of the main criticisms of this study is that it’s based on historical data, and the future cannot be predicted with historical data. If it could, we’d all be rich.

Regardless, history’s the best we’ve got so let’s simulate the 4% rule. In the below:

- I use a website called Cfiresim.

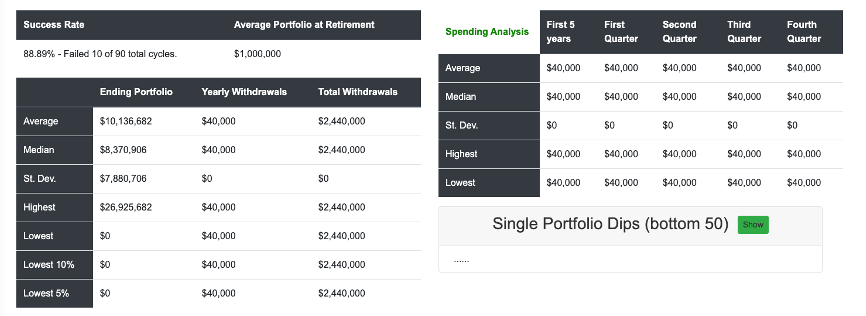

- Assuming you have a $1,000,000, you withdraw $40,000 each year (4% rule). The absolute amounts are just a numerical example and doesn’t matter. You could have $100,000 and withdraw $4,000 and the math is identical. Simulation’s run on historical data.

- We do a 90% stock/10% bond allocation. The entire time.

- The simulation assumes a 60 year withdrawal horizon, from 2022 to 2082. For example, you’re 30 years old now and want to retire until 90. That’s probably the most stressful test one could do on the simulation—if you’ve only 5 years until you die, you don’t need as much money or consistent returns for you to not run out of money.

- Fees assumed to be .18%. Keep in mind that if you withdraw money and your taxes aren’t 0, your “fees” will be much higher. A $40K withdrawal here can be back-calculated to a post-tax spending of 32,974 in California, and 33,845 in Texas.

- Simulation also takes into account historical inflation so the $40K withdrawal per year is already inflation-adjusted.

- The 4% rule with assumptions above has a 88.89% success rate.

- “Success” is defined as not running out of money before you die.

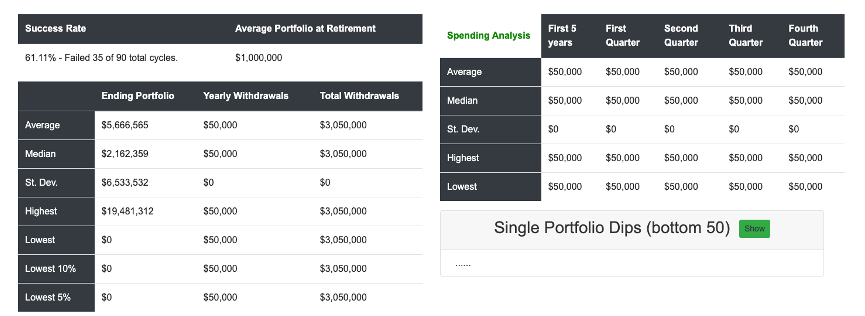

It should be intuitive that the higher the withdrawal rate, the lower your probability for success. Below is a simulation of withdrawing 5% per year (all other assumptions are the same). This yields a 61% success rate only.

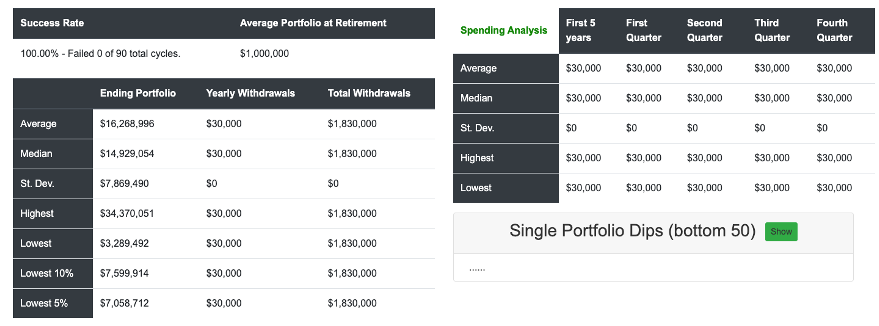

Now consider 3%. The simulation gives 100% success rate based on historical data. But obviously, past returns are no indication of future returns. Take “100%” with a huge grain of salt.

Guidelines, And The Main Problem

Basically, if you’re very conservative you could try to adhere to the “3%” rule, where you save 33X your annual expenses before retiring early and achieving financial independence. If you’re more cookie-cutter and can face more risk, perhaps do the 4% rule. And if you’re somewhere in between, you can do a 3.x% rule, where “x” is determined by your own risk adjustments and what you see on cFireSim.

If you’re in the camp that future returns will be much higher than 4% after inflation, you might go with the 5% rule.

But those are just guidelines, and guidelines are meant to be broken.

The main problem with the FIRE community and the 4% rule is that you can’t predict the future, with any kind of certainty. You’ll be safer withdrawing less, and you’ll absorb more risk withdrawing more. Simple as that.

But you can’t guarantee 100% success rate and your future returns aren’t guaranteed. You can only minimize risk to a point until you’re comfortable taking the leap to declare financial independence and retire early. If you need to wait for a 100% guarantee that you won’t run out of money, the only solution is to work until you die – for most, this guaranteed downside of working for life is not worth sacrificing the potential upside of early retirement, especially if your chances of success is quite high.

You can get as close to a “100% guarantee” with never running out of money as possible. But since it’s inherently impossible to forecast the future, you can’t be 100% sure your money will last you a lifetime.

This is analogous to the same problem with AI driving. It can be much better than human drivers, but you can’t have 100% chance that the car won’t get into an accident. Only asymptotically close to 100%.

So, you decide. How close to 100% success do you need to be in order for you to take the leap to FIRE?

Criticisms Of The X% Rule, And Other Solutions

One of the criticisms of the above assumption that you should just withdraw X% per year is that the market is volatile. Applying a fixed withdrawal strategy to your nest egg is silly. This is because withdrawing X% in some years could be remarkably detrimental to your returns for the next 20 years. And withdrawing the same X% in other years would be insignificant to your compounded growth.

One way to solve this problem is through dynamic spending. On cFireSim, they allow you to adjust what’s called the “Z-Value”. Here’s the website’s explanation of their Z-Value field:

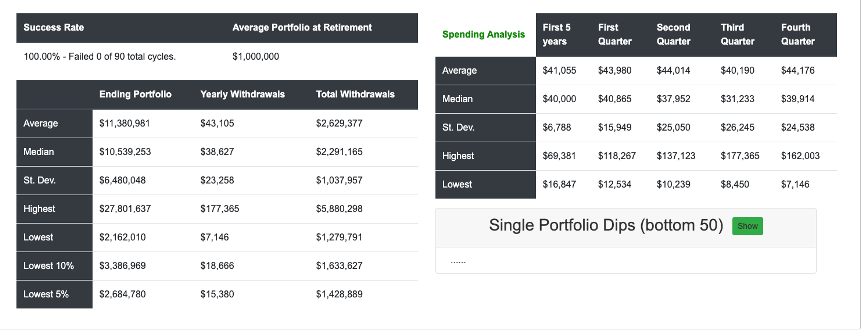

The Z-value determines how much your spending changes during the market changes. The method then tracks an inflation-adjusted version of your Spending amount. Example: If your portfolio is up 10%, Z-value is 0.5, and Spending was $40k, your new spending is now (1+(10% * 0.5)) * $40k = (1.05)*40k = $42000. Example2: If your portfolio then is down 25%, Z-value is still 0.5, Spending was $42000, your new spending is now (1-(25% * 0.5)) * $42k = (0.875)*42000 = your $36750. So, the z-value just provides a value of how much your spending reacts to your portfolio health.

Again, using the same assumptions above, with a 4% base spending, a Z-value of 0.5 means you get something like this (no floor, no ceiling):

This is very conservative. If your portfolio drops 30%, you are spending 15% less each year. This lets the market recover. And if your portfolio goes up 30%, you are only spending 15% more each year. As the market is generally bullish, you’re biased towards growing your portfolio despite a 4% base spending.

But caveat here is some years will really suck. Lowest spending in the 60 years is $7.1K! That’s a horrible year and you can’t really say you’re ‘retired’ spending $7.1K in a year. The simulation also allows you to set a “spending floor” to cover bare minimum expenses as a constraint. This is not shown here and will be left as an exercise for the reader.

The main purpose of this post is to show you some of the tradeoffs of various withdrawal tactics/rules, and show you some features of that cool cFireSim website. Because everyone’s risk tolerance profile and preference for retirement varies wildly, it’s impossible to cover every case here. So I highly suggest you use the website and play around with it to see what works for you.

So When Should I Declare Financial Independence And Retire Early?

People on forums and YouTube argue about the “4% rule” a lot.

Some say it’s not enough. Some say it’s too much. Some say it’s just right and just “don’t worry about it”.

Some say a fixed withdrawal model isn’t flexible enough as a strategy and you should withdraw based on what the market’s doing, or some other factors like CAPE.

The verdict is that it’s up to you. Each camp essentially are voicing the upsides, downsides, tradeoffs, and risks of each model. And it’s up to you to see:

- How much safety margin you want for your retirement.

- How cheap or luxurious you require our retirement to be.

- What kind of safety margin you’d feel comfortable with in your retirement.

- How much risk you want to absorb.

For example, you can have folks on both extremes of the spectrum:

- The most conservative, which is to work forever and never “retire early” nor ever declare “financial independence”. The trade-off here is that you lose a lot of valuable time in your life that you’ll never get back.

- The most risky, which are people that are OK with just withdrawing 5-10% of their net worth, every single year, despite what the market’s doing. The risk here is you run out of money and you’ll suffer when you’re forced to get a job again once you’re much, much older and your skills have rusted.

For me personally?

I’ll work forever because I have ambitions of $100 million+. But I’ll declare FIRE and quit my job which I hate when I reach $5 million, or when I’ve got 20K/mo (after tax, so 40K/mo pre-tax) side income coming in for a trailing 9 months. Basically, I want:

- An unofficial “FIRE” at $5 million net worth or $40K/mo in income, whereby I can stop doing stuff I hate for money.

- Continue working after my unofficial “FIRE” to tackle challenges and other things I enjoy, while playing the game of making money / providing value to society.

This is an excellent, unbiased overview of FIRE and how the numbers work. I agree with your statement, “The verdict is that it’s up to you.” You’re absolutely right—there are so many variables, and so much of it depends on your situation and preferences.

I am impressed and, TBH, a little stunned by the $100 million+ you hope to amass! Wow, that’s a big number! I hope you reach your $5m goal soon so that you can pursue the next $95m in a more fun and enjoyable manner. 🙂

Thanks Chrissy! I’m super excited to get to the point where I can reach the $5m goal to FIRE for sure! I don’t know that $100 million is achievable but I feel like the journey of trying to solve those big problems in order to amass that wealth would be quite a fun one!

Thanks Angie, definitely a good in-depth post on FIRE.

Very impressive you’re aiming for $5 million before you retire, quite the big sum!

I agree that for some a 4% SWR may be a bit risky. Have you ever considered a tapering approach to the SWR to help you reach your FIRE number faster?

The thinking behind it is that at 60 many people will still have a lot of get up and go, so will want to have holidays, lots of meals out etc. However, at 75+ the amount you’d spend each year will probably be a lot lower.

Haven’t seen this scenario brought up many times before and interested in your view!

Thanks!

Hi John, I think you could probably do a tapering like you mentioned. Though I think there are 2 details to consider when planning this for yourself:

1. You’ll need to be somewhat accurate in determining when you’ll run out of energy and no longer have energy to travel and do fun things. Otherwise you may end up in a situation where you’re 75 and have tons of energy but afraid to use it.

2. A decrease in energy to travel could correlate with decreasing health. Meaning that a decreased expense in “adventure” could mean an increased in healthcare costs.

More on point 2 is you may travel less frequently as you’re older, but you may travel more in “style.” Here’s an example: if I ‘m 50+ years old I may want to exclusively travel long haul in business class. This is because I may be more susceptible to things like deep vein thrombosis and laying down is a.better alternative than sitting for a long period of time. So while I may travel less frequently as I’m older, I might “treat myself” during those travels which’ll incur high costs.

That said, I think tapering can still work: you just will need to be more accurate than you’d otherwise need to be and consider a lot more cases.