So you wanna be rich, and you stumbled against call options. But what are call options?

In this post, I’ll go through:

- Why buy call options

- What are call options

- And some examples of some options, and discussion of a few basic concepts related to calls.

Table Of Contents

Why Call Options?

Call options are a tool where you can have unlimited, massive upside gains. This is partly due to how they work: they’re heavily leveraged financial tools.

Call options also have a limited downside. When you buy call options contracts, whatever price you paid for them is the maximum amount of money you’d lose.

Hence, with:

- Unlimited upside

- Limited downside

This is an attractive strategy for investors looking to do “10-baggers” but don’t want to risk a ton of money to do it.

Unlimited Upside And Limited Downside? Too Good To Be True!

Yes, you’re right.

Even though the basic finances of call options are great, they have one very bad thing going for it: they’re extremely risky.

With calls, you’re very likely to lose all your money because if your option expires “out of the money,” all your money is gone.

- “Out of the money” just means that your strike price is underneath the underlying stock’s price. More on this later.

To really be profitable with call options, you need to predict 3 things:

- The direction the price will go.

- The magnitude of the price action.

- When the price action happens.

Doing any one of the above 3 is very difficult, let alone all 3. But if your gamble is correct, you’ll win a lot of money. Your hope is just that the massive losses you incur on many trades can be offset by that one trade that nets you a ton.

What Are Call Options?

A call option is just an option (but not an obligation) to purchase shares by a certain date. More specifically, there’s 2 variables in calls:

- Strike price – what price you’ll buy each share at.

- Expiry date – when’s the latest you’d buy the shares at the strike price?

Note that each call option contract is representative of 100 shares. This means that unfortunately, you can’t really dip your toes in the water and just buy a call contract for 2 shares only.

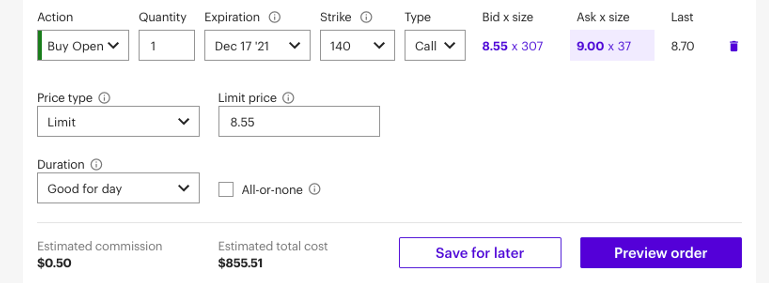

Even more confusing is that on trading dashboards, the pricing is usually per share – only the final cost reflects the 100 shares associated with the contract. Here’s an example below:

- Market’s crashing right now and I want to buy a call option for TQQQ that’ll expire December 17th, 2021.

- I want to buy at a strike price of $140. Its currently share price is $127. My strike price is above the $127 – this is known as an “out of the money” (OTM) call. All an OTM call is basically saying: if your contract expired today, it’d be worthless.

- Each share is $8.55 and if I set a limit price of $8.55, the call option will cost $855 because it represents 100 shares at $8.55. See picture below and you’ll notice that the “bid” is $8.55/share but my “estimated total cost” is $855.

- If TQQQ goes to $141 on December 17th 2021, then my gross profit $100. This is because I can buy 100 shares at $140 and sell each of them at $141.

- Unfortunately, the contract itself costs me $855.51 (also called the contract premium), so I’m actually down $755 if that happens.

- Thus, in order to breakeven, TQQQ would need to be at ($141 + $8.55 = $149.55) at the time of expiry.

Purchasing Calls With Strike Price Lower Than The Underlying Stock Price

“You mean you can choose what price to buy the stock at? Why not just buy a billion shares at $1 then?”

- This is because the contract for the option itself costs a premium.

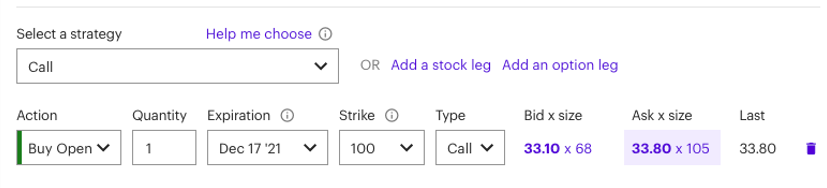

- You can certainly buy a call option that has a strike price (i.e. the price you’ll purchase the shares at) at a much lower price than its current price. When you buy a call option with a strike lower than its market price, that’s called an “In The Money” (ITM) contract. But the price differential is priced into the contract premium. Example:

- TQQQ is at $127 right now. I’d like to buy $100 calls expiring December 17th, 2021. Here’s what the pricing of the contracts look like.

At a 100 strike, you’d expect the contract premium to cost $27. This way, I can’t just buy a billion shares at $100/share and sell it at market price at $127.

But notice this contract costs $33/share, not $27/shares. Why’s that?

This is because December 17th still months from now. And this is where “theta” (AKA time) in options comes in. Because there’s still time left in the contract, TQQQ could potentially go up to $133 by December 17th, causing me to breakeven. The $6 extra per share is a premium I’d have to pay buying in the money because of the potential for the stock to increase by mid-December.

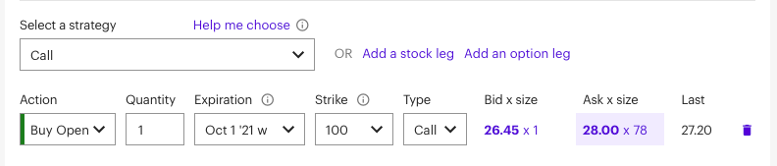

Conversely, let’s take a look at the same strike price that ends in 3 days. Unlike December, there’s a lot less time left for the stock to move here. Intuitively speaking, the corresponding options ought to be cheaper. And they are:

Notice the bid-ask is between $26.45 and $28. The midpoint is only slightly above $27. The reason for this is because there’s 3 days left for TQQQ to move. Hence, there’s not much of a premium you have to pay. The shorter the time to expiry, the smaller the potential for the stock to do wild moves.

Should I Trade Options?

Options are very risky. As such, I do not recommend it to most people (i.e. people who aren’t degenerate gamblers).

And even if you’re a complete degen, you should only trade call options with money you can lose.

Another thing is: don’t do short-term calls. You’ll likely lose every dime. You hear stories of people YOLO’ing into a SPY OTM call contract with a 2-day expiry and a miracle happens. They become a millionaire with $1000 overnight.

That’s not going to be you. You’ll be the story where you put $10,000 into a 3-day expiry and no miracle will happen. Your option will expire worthless and you’ve very efficiently incinerated $10,000.

So…don’t do that.

Look at the most legendary call options players like DFV from WallStreetBets. They generally buy LEAPs (Long-term Equity AnticiPation Securities). LEAPs are contracts that expire at least a year or 2 out, depending on who you ask. Folks who buy LEAPs know that the stock will go up, but they’re not going to make an insane bet and say it’ll go up in the next few months. They’re making more of an educated guess on the price action over the next year / few years.

- Even if you buy LEAPs, it’s still very risky. You’d not only need to predict the direction of the stock (this is hard enough), you’ll also need to predict how high it’ll go, and you’ll need to predict if it’ll reach that point by a certain date. Predicting one or 2 of those things is close to impossible. But you need to know all 3 to win.

- But it’s high-risk, high-reward. For example, a stock can go up 16X but an underlying option can go up by 1000X.

- Thus, if you’d like to expose yourself to nonzero probability “10-baggers” or “100-baggers” you might consider having a tiny portion of your portfolio in options.

- But I wouldn’t recommend anything significant in call options. You’ll most likely ruin into financial ruin.

Generally how people trade calls are:

- They put money in just the regular stock.

- They supplement a little bit of money with OTM calls.

If the stock does particularly well, then the OTM calls become extremely profitable. If the stock takes a lot longer to gain traction, then you only lose the small amount you put into the OTM calls.

If reading this short piece you’re ready to gamble away your life savings, here’s my E-Trade affiliate link here. Signing up will give me something – but I forget what.

Or, you can just buy the S&P 500 and make more money.

0 Comments

Trackbacks/Pingbacks