In this post, I’ll have covered called explained in layman’s terms. And talk about a case study of how I indirectly use covered calls to make income.

Table Of Contents

First, What Are Call Options?

If you already know what call options are, you can skip this. There’s a more comprehensive, beginner’s guide to call options here. I highly recommend reading the article if you don’t know what a call is, because the rest of the article will be very confusing otherwise.

But if you’ve read about it somewhere before and forgot, here’s a quick refresher of what a call is:

A call option is an option you buy where you’d get the option but not the obligation to buy a certain stock at the strike price, before or on the expiration date. Thus, a $100C Sept 20 2022 for stock $XYZ means you can buy $XYZ at $100/share on or before Sept 20, 2022.

Covered Calls, Explained

When you buy a call, someone has to sell you the call option contract.

Each call option contract represents the right to purchase some shares underneath. If you do decide to exercise your right to purchase, the seller of the contract must provide you those shares. For example:

- You bought 100C of $69 XYZ, expiring Sept 20, 2022.

- You want to exercise your right to purchase on June 20, 2022.

- The writer of the call option contract (the guy who sold it to you), must provide you the 10000 shares of $XYZ so you can buy each share for $69.

Because 10000 shares of $XYZ is involved here, the seller can sell call options in 2 ways:

- He can sell call options ‘naked’, which means he doesn’t have the 10K shares on-hand. When you exercise your option as the buyer, the seller must then purchase 10K shares at market price and then give it to you. This likely results in losing a lot of money for the contract-writer, if exercised.

- He can sell ‘covered’ calls, which means he’s got the 10K shares in his account already when he sells you 100C of $69 XYZ. This way, at any time, if you wish to exercise your call option, the seller of the contract can just transfer his shares to you.

Here are some numerical examples of both covered calls and naked calls with their risk explained. For the following examples, let’s flip your position. This is easiest in getting the examples explained: here—you’ll be selling calls, both covered and naked.

Naked call example:

- You sell 100C of $69 XYZ, expiring Sept 20, 2022. If price exceeds $69, and the buyer of the contract wants to exercise his option to purchase $XYZ at $69/share, he can.

- Price now is $50.

- And say your premium is $5/share for this contract.

- It is now Sept 20, 2022 and price is $120. The buyer wants to exercise his right to purchase.

- You didn’t buy the shares at the time you sold it, so you need to buy it now at $120/share.

- You lose cost to purchase shares minus what you collected for premium minus what they’ll pay you per share: $120*10000 – $5*10000 – $69*10000 = $460K loss.

More generally, your max loss is unlimited since cost per share at time of redemption is unlimited. Run the same example, but the stock’s at $300: You’d then lose (300-5-69)*10000 = $2.26 million loss.

Max gains here would be your premium collected, or $50K potential profit.

Explained covered call example:

- You sell 100C of $69 XYZ, expiring Sept 20, 2022. If price exceeds $69, and the buyer of the contract wants to exercise his option to purchase $XYZ at $69/share, he can.

- Price now is $50.

- And say your premium is $5/share for this contract.

- But now, you have purchased 10K shares at $69/share to hedge your bets.

- It is now Sept 20, 2022 and price is $120. The buyer wants to exercise his right to purchase.

- Because of your hedge, you get back the $69/share from the buyer. And you’re breakeven there. What remains would be your profit, which is $50K profit.

Selling covered calls make your losses limited. Notice here that it doesn’t matter if the price was $120, or if it had become $800. As long as it’s above the strike, you make $50K profit. Your main “loss” is in opportunity cost, meaning you won’t be able to participate in massive gains if the stock had in fact increased to $300/share.

Your max loss is the following: stock drops to 0. This means you lost 69*10K – 50K = $640K max loss.

Gains here is tricky since you own the stock. A few scenarios:

- Price stays the same by expiry – or price exceeded $69. You’re up by $50K.

- Price is $69 at expiry. You’re up by the $50K in premium, plus $19/share, or $190K + $50K = $240K max profit, by expiry.

- Price is $30 at expiry. You’re up the $50K in premium, but your equity has tanked by $39/share, resulting in a spot loss of $390K – $50K = $340K loss.

There’s quite a wild range of results here. And if you have high conviction in the stock, you might collect the $50K and have the stock tank to $30/share. You might not lose any money in the long-term if you held on and let it appreciate to $120 over time. Because you can sell any time after expiry date to your liking, it makes the PNL calculation tricky for the final scenario.

Ergo a word of advice is this: you should always sell covered calls only if you have strong conviction in the company and if you’re OK holding the shares long term. Selling covered calls just basically means you believe the stock will appreciate, but not so disgustingly fast that it’ll hit the strike. Thus, in adverse scenarios where the stock tanks due to macro conditions, you can just HODL with conviction without worry.

Wow, Seems Risky. Covered Calls Aren’t For Me Then. Case Study: Make Income From Covered Calls Easily, Explained

The problem with selling covered calls is that your max loss is the value of all your shares minus premium collected.

And, if you don’t have to give up your shares, the other problem is that the underlying stock has crashed.

OK – so how do you counter both these issues, which are problems of:

- High loss from volatility, and

- Poor stock performance?

And how do you counter these 2 problems, easily? Here it is explained: just buy into something called $QYLD. $QYLD is a fund that sell covered calls for the NASDAQ 100. Here, you’ll solve both problems because:

- Volatility is blunted by some diversification (across 100 stocks). You also have better control of your bet-sizing. You just buy into QYLD as common shares and all the complexity is abstracted away from you. You aren’t required to sell 100 calls of a certain stock to make money. In other words, you get much better per-dollar diversification than you would doing it yourself, because the fund has more money than you.

- Poor stock performance will be in the short-term as NASDAQ and SP500 always rises over the long term. Short-term stock performance means better yield as the fund’s counterparties won’t be able to redeem their options.

Most stocks pay dividends on a quarterly basis due to having to do accounting each quarter. QYLD just sends the printed money to you each month.

Before I show you numbers for QYLD, I want to compare this to a real estate lending that pays 6% per annum. On a $100K basis, I get paid only $350 a month:

This is odd, because $6000/12 is $500/mo. So the 6% that the fund promised isn’t even 6%. But to be fair, I just started dumping money into this fund so maybe the 6% gets accelerated at the EOY. Like a 6% IRR. So let’s assume I get paid 6% by EOY, for $6K. Best case scenario.

Here are the historical dividends for QYLD.

- Lowest yield is about 6.62% back in 2017.

- Highest was 12/29/2021, at a whopping 26.92%! Though the numbers may be incorrect on this site, so let’s take a look below on Nasdaq’s site and also my actual numbers.

Keep in mind yield is annualized, so those number must be divided by 12 for your per-month income. For some reason, the previous linked site is missing quite a few months as compared to Nasdaq’s own reports. So for the below historical data, I just use the latter.

- I’ve got 436 shares, with cost basis $22.88/share = $9975.68 (yes, the value’s crashed since then but I’m not looking to sell any time soon).

- Given the 2021 monthly yields, I would have gotten $1242.84 in passive income, or 12% — or double the real estate lending yield.

And the great thing about QYLD? You don’t have to throw 100K at a time. Less risk for more juice.

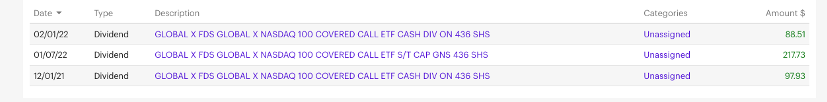

The above numbers are if I actually put it in the market for that long. But to date:

- I got $88.51 in February 2022.

- I got $217.73 in January 2022.

- I got $97.93 in December 2021.

So just $403.97 in the 3 months I’ve invested into it. This extrapolates to roughly $1212 over a year. Or 12.14%.

So on a $100K basis, I’d expect to get $12K/yr passive income with this.

Risks With QYLD

You might be tempted to go YOLO on a dividend fund. Don’t. Never YOLO. This is coming from someone with an extremely high risk tolerance:

As you can see, my portfolio has almost max risk which is a very dumb thing to do.

And I’m telling you not to YOLO into something that looks safe, like QYLD. The reason is because you can’t tell the future and it’s unlikely that you’re able to absorb losing your entire portfolio’s worth of money. The upside is limited at 12%/yr and your downside is 100% of your money.

While normally safe, I can’t guarantee there’s no black swan events with QYLD so as always, you should only allocate what you can lose in any security.

0 Comments