Some financial pundits like Suze Orman or Stephan Graham to make it seem like that as soon as you order your first grande caramel frap from Starbucks, you’ll be pulled into a deep, dark hole of financial irresponsibility and end up homeless.

The main argument against Starbucks and other fancy coffee places is essentially of opportunity cost: “You spent $2400 last year on Starbucks – if only you spent that $2400 in paying off your student loans, you’ll be way further ahead!” Likewise, the S&P 500 between 1926 through 2018 has an annualized return of roughly 10%–11%. This means that $2400 that you spent on Starbucks this year could be worth $6224 in 10 years if you had just invested it in the S&P500!

By the way, the $2400 is approximated at $6/coffee, with roughly 400 days per year.

On the other side of the “Starbucks Dilemma” are financial pundits like Ramit Sethi that argue it’s OK to spend money on Starbucks as long as you’re consciously spending your money: that is, your $2400 on Starbucks is budgeted as an expense beforehand and in exchange, you’ll not buy $2400 of something else. Further, there’s the “good life” argument that if you want to spend money on Starbucks, you should just get Starbucks because it makes you happy. If the $2400 goes missing at the end of the year, the Starbucks experiences yield you more happiness than some other material goods worth $2400.

So where do I stand on this? Both sides make strong points and I agree with both sides somewhat… but I think you absolutely should never buy fancy coffee at all, but not for any of the reasons above.

Table Of Contents

Why Starbucks Will Make Your Broke (Indirectly)

Let’s get one thing straight. Spending $2400 or even $5000 a year on Starbucks won’t make you broke directly. Even if you were to save your $2400 and it yields $6224 in 10 years, that’s only $624/yr! That’s not going to change your life in any meaningful way.

Instead, you should avoid fancy Starbucks drinks because it builds very poor financial habits.

Having the right habits are of utmost importance because habits are the building blocks of what you do. Having the right financial habits makes you spend your money on things with a higher return subconsciously. Having the wrong financial habits make you spend your money on things with a lower return subconsciously. Sure, you can fight against bad financial habits with willpower, but that’s miserable because you will need to consciously and painfully prevent yourself from spending your hard-earned money on other things — this internal conflict will offset any happiness or joy you gain from getting your Starbucks hit.

It’s pretty well-known that instead of $6 for a coffee, you can make the same thing at home for under a dollar. Every time you buy an expensive coffee, you’re training yourself to say it’s OK to buy something that costs 6 to 30 times more than normal.

Over 10 years, you might only lose $6224 as a direct result of spending $2400/yr on Starbucks, but you might indirectly lose a lot more because you’ll take the same mentality of “Oh, it’s just a few bucks” on all your other purchases. Worse yet, you might take the mentality of not thinking critically through the ROI of your purchases in a much larger investment, which is extremely dangerous. You might participate in a high-ticket investment where you’re paying 6-30 times more than normal but because you’ve trained yourself not to look closely and not to associate pain with overpaying, you forget to do your due diligence and lose hundreds of thousands.

For me, buying Starbucks or any other fancy coffee won’t move the needle for my net worth at all. But every time I see fancy coffee and a long line of people lining up, it’s like watching a bunch of gambling addicts lining up at a casino: it’s just a bad investment and I don’t want to subject myself to bad investments.

Also, is Starbucks really that much better than homemade coffee? One could make the argument it tastes a lot worse since you could make coffee a lot more fresh at home. You have sugar and milk at home, and you also have whipped cream at home. So if it’s not the taste of the coffee that justifies its cost, what does? Would you pay a massive premium to drink Starbucks just because it says Starbucks on the cup, coffee being equal?

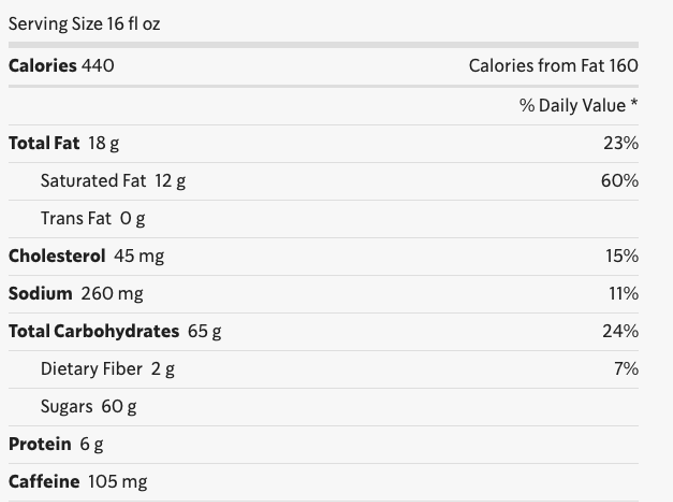

Another really important reason why you shouldn’t buy Starbucks: there’s too much sugar by default and it isn’t healthy for you at all. A Grande Java Chip Frap has sixty (60) GRAMS OF SUGAR!

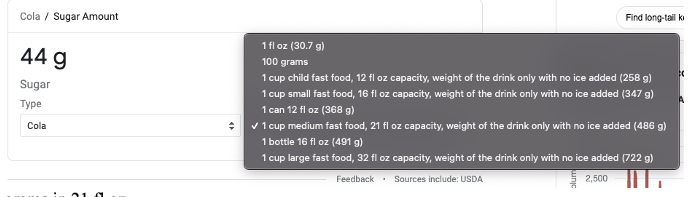

For a healthy adult, there’s normally only 4 grams of sugar floating around in our bloodstream at any given time. You can exhaust and eliminate all the sugar in your blood 15 times over with this drink only (assuming you don’t eat any other sugars for the rest of the day). Compare this to a well-known unhealthy drink, Coca-Cola:

A grande (16 fl oz) has 60 grams of sugar, while coke (which is arguably just sugar shoved inside a liquid) has 44 grams of sugar in 21 fl oz.

Not only are you pissing your money away, a long-term Starbucks habit can ruin your health. So I definitely don’t buy the whole “you should buy Starbucks as long as it makes you happy” argument.

Usually in the pursuit of wealth, people sacrifice their health. With Starbucks, you get to lose your wealth and your health.

Conclusion

Buying Starbucks won’t make you broke directly, but the subconscious habits it instills makes it so that you’ll have a very hard time making correct financial decisions consistently. And it’s these consistent decisions that help you win the game long-term.

Very wealthy people like Kevin O’Leary, amongst a lot of other financial gurus advocate against coffee for good reason. It’s not about the coffee solely – it’s about not having the habit of wasting money “because it’s only a few bucks here and there.” A coffee habit can cost $2400/yr, but it’s like a “gateway” spending habit where you might accumulate other expensive habits as well: paying an extra $500/mo premium on rent that you otherwise didn’t have to / couldn’t quite afford, signing up for premium subscriptions that you don’t need…it all adds up. So while the coffee itself won’t make you broke, the mentality of being OK with spending much more than necessary will accumulate and that accumulated amount of extra spending will make you broke.

Not to mention Starbucks is mostly tasty because they add a ton of sugar and fats to their coffee, to the point where most of their premium coffees don’t take like coffee at all.

At the risk of being ambiguous, here’s my position:

With a Starbucks habit, you’ll end up broke. And as a consolation price, you’ll get to have diabetes as well.

But you still need to drink good coffee: this post highlights how you can get good, cheap coffee at home with minimal effort.

P.S.: This is a new blog and if you’ve found this helpful at all, it would mean the world to me if you were to share this post to someone that you think this post might benefit. It would also be immensely helpful to me if you could give me any feedback on the content at hello@goodmoneygoodlife.com

3-Day Freedom Challenge

Sign up for this 3-day challenge to automatically save & invest your way towards financial freedom!

0 Comments

Trackbacks/Pingbacks