If you follow this blog, you’ll know I’m not a big fan of buying rental properties in general, and in particular I think everyone should avoid single family rental homes. But if you do insist on buying real estate, I’ll show you exactly what to buy and where you might consider buying it.

There’s a few classes of real estate: class A, B, and C. Generally speaking:

- Class A yields the highest appreciation and lowest cash flow,

- While class C yields the lowest appreciation and highest cash flow.

I recommend buying small class A properties (like apartments) in metropolitan areas that has a track record of growing, and that you think will continue growing.

Table Of Contents

Why Buy Class A Real Estate?

Class C seems less risky because you get more cash flow. And it might be less risky…in the short-term. But class A’s properties generally appreciate a lot more and appreciation dwarfs cash flow.

As an example: say you didn’t follow my recommendations and opted for cash flow in a market that isn’t expected to grow. Say you did well and you bought a $150K property with a $300/mo cash flow after projected expenses (operating costs, utilities, property management fees, capital expenditure, etc). Great work.

You’ll now earn $3.6K/yr and after 20 years you can underwrite earning roughly $72K. Value of the home after 20 years is likely to appreciate, but not by much. Conservative underwriting would suggest we say you’ll only earn $72K over 20 years and your home value stays the same.

You’ll also have a lot of headaches with these properties, generally speaking. But let’s say you don’t mind it. Let’s take a look at some graphs of metro areas:

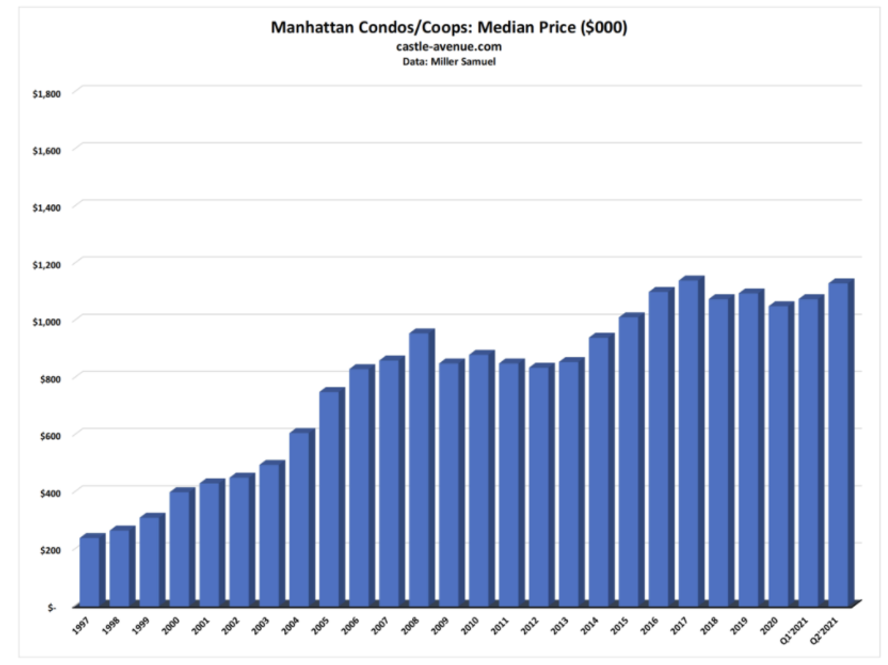

According to castle-avenue.com, it seems like NYC median condo value has increased from roughly $400K to around $1.025 million from year 2000 to 2020 (during pandemic when NYC took a huge spanking in their real estate markets).

This is an equity multiple of around 2.56X over 20 years and if we cost-adjust it to say the building cost $150K instead of $400K, we’re talking about a $234K gain over 20 years. This completely dwarfs any cash flow gains in a stale market.

This is just NYC though. Another place where you might buy real estate is a cleaner, less noisy, more civilized, less stinky NYC: Hong Kong. According to FRED:

Q1 housing index in Hong Kong was 66.48 and Q1 2020 was 184.53. This is roughly a 2.77 equity multiple, and adjusted to $150K would be a $265.5K profit over 20 years.

Appreciation. Trumps. Cash. Flow. Every. Single. Time.

Caveat if you buy class A real estate: You won’t cash flow with these. If you can cashflow with a class A even with strict underwriting, that’s obviously a great deal. But the expectation for these is you generally won’t cash flow. An anecdotal example I have is in these Bay Area Meetups I used to go to, investors would be completely surprised if a person managed to purchase a cash-flowing property in San Jose. “Cash-flowing” defined as net positive cash coming in after mortgage and projected operating costs, capex, etc.

Caveat #2, don’t buy real estate anywhere and just do this?

Here’s an S&P graph between 2000 and 2020.

This is a 2.27 equity multiple. This is arguably much less than buying class A real estate, but 3 things:

- SP500 is no headaches, and 100% passive.

- Post-COVID, technology companies actually made SP500 explode (i.e. comparing a 20-year from August 2000 to August 2020 would yield a 2.97 multiple), so the 2.27 is just a small snapshot in time.

- You don’t have to throw down $150K or $400K, or take on a 6-figure mortgage to invest in the SP500. You can just toss $3000 to VFIAX in Vanguard, or $50 in SPY.

So SP500 can do roughly the same performance (or better in some timeframes) than class A real estate. Thus, I’d recommend doing SP500 first and then do class A apartments in metropolitan areas if you want to diversify away from the stock market with roughly equal returns (and maybe enjoy some tax refunds in the form of depreciation).

Why Buy Small Apartment Real Estate?

You want to minimize capital expenditure and operating costs. A lot of renovation costs is by square footage or linear feet. Example: Rehab for my cheap 2600 sqft property cost a high percentage of what the property’s worth because it was so big.

Compared to a tiny 300sqft apartment, there’s just a lot more flooring to potentially be replaced and a lot more walls to paint. And because these huge cash-flowing homes also command a lower rent when compared to NYC highrises, it takes a lot longer to recoup costs.

Conversely, a small 300sqft would not cost nearly as much to repaint as a 2600sqft house, and a metropolitan 300sqft could command higher rent than a 2600sqft Memphis home. Thus, you’ll recoup expenses much more rapidly when you rent out the 300sqft apartment.

Summary

I am not a huge proponent of real estate. But if you have to, I think the best places where you can buy real estate will be big cities that can’t really ever go away. And buy a small space.

In other words, the best way to buy real estate is to minimize your losses (fewer operating costs/capex by way of getting a small apartment) while simultaneously maximizing your gains (i.e. prioritizing appreciation over cash flow).

Minimizing losses/risk and maximizing gains yields the best probability of making the most amount of money.

Can’t I have Both Appreciation And Cash Flow?

Yes. Ideally your property would have both.

These are more common in real estate syndications where you force appreciation in an apartment complex that’s underpriced (i.e. the cash flow is increased, and return the NOI is increased, which increases the value of the property). But if you can’t find those deals or you have to make a tradeoff, you should definitely prioritize appreciation over cash flow.

Can I do both?

Yes. Ideally your property should appreciate and cash flow. These are more common in deals where you force appreciation in an apartment complex that’s underpriced (i.e. you can increase cash flow and NOI and increase value of property). But if you have to make a tradeoff or can’t find those deals, definitely prioritize appreciation over cash flow.

P.S: Me love you long time if you engage with me at hello@goodmoneygoodlife.com. Me love you even longer if you share this with a friend that might benefit from this info.

0 Comments

Trackbacks/Pingbacks