If you’re new to the stock market, you might see that you can buy stocks in a bunch of different ways with your brokerage. In this post, we’ll talk about what is a limit order in stocks, and we’ll also discuss what “market” orders are (and why you should avoid them).

I’ll show you some example of what limit orders are, and how they can save you thousands on some trades.

Table Of Contents

What Even Is A Limit Order In Stocks?

A limit order just says “what’s the maximum amount of money I’m willing to pay per share, for a stock.”

For example, let’s say $TQQQ is falling and its stock price is $122.4. You might decide you’d like to catch a falling knife by going in if it falls to $122/share.

To do this, you’d simply set a buy order limit at $122/share. When the stock falls to $122, your brokerage will automatically buy the number of shares you specified.

Limit orders are crucially important and should basically be the only way you ever buy stocks due to the following reasons:

- You’ll always know how much you’re paying for the stock. For example, if you set a $122 buy limit at $100 shares, you know you’ll never be charged more than $12200.

- This lets you calculate your risk accurately. If you want a certain % return on your cost basis (risk), you must know what your cost basis is. If you don’t know how much your shares cost, how would you know if you’re taking too much or too little risk?

- Buy limit order in stocks protects you from wild market swings. If you specify a stock should be bought at $122/share and it bumps up to $125/share for a few seconds right as you press the “confirm order” button, you won’t lose $3/share.

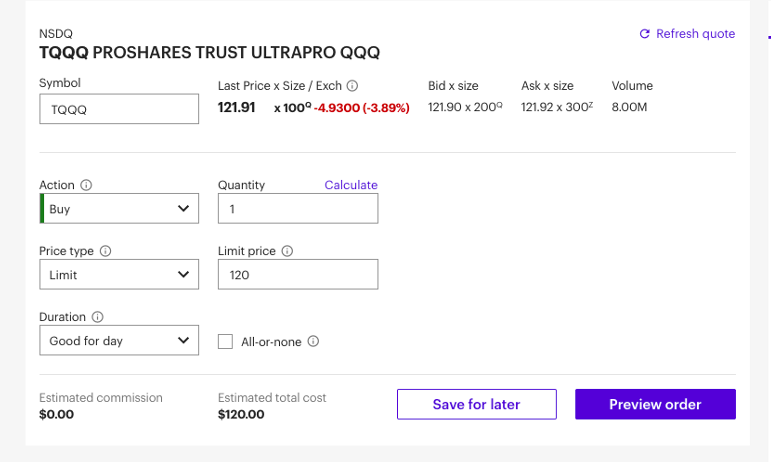

Lastly, limit orders are super easy to execute. For E-trade, you’d just click on the price type dropdown menu and press “Limit,” set the limit price you want to go in at, and you’re done. In the below example, TQQQ is $121.91 and I’m wanting to purchase 1 share at a limit of $120/share. So, if the stock falls to $120/share, it’ll go ahead and buy it. Here’s how it looks on my E-Trade dashboard:

Market Orders, And Why You Should Never Use Them

If you put in a market order, you’re basically telling your brokerage you’ll buy the stock at whatever share price is currently at.

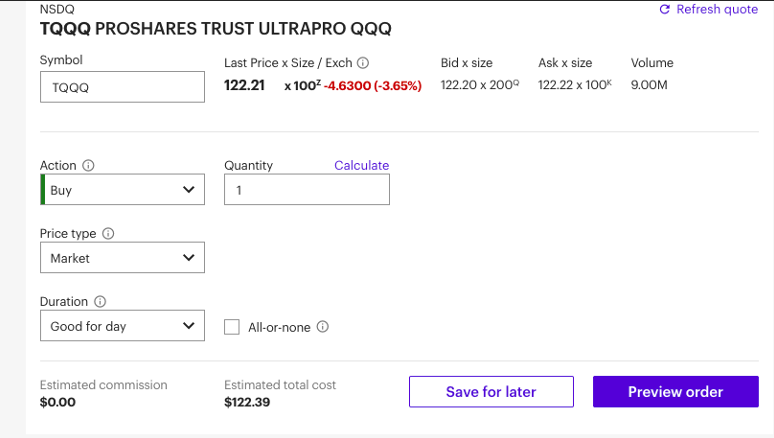

In the below example, I’d like to buy a single share of TQQQ at market price. The market says the shares are worth $122.39 right now. Thus, if I enter in my order, I might pay $122.39/share.

Or, I might not pay $122.39/share. I might pay $122.1 per share or $122.6/share. Nobody knows.

By the time you’ve confirmed your order, the stock could have moved one way or the other, so it’s impossible for you to know exactly what you’ll pay for your shares.

The only advantage to market orders is you save a couple seconds by not having to enter a “limit.”

The downside of market orders is that you’ll lose a lot of money being lazy. You might be OK most of the time if you were to buy S&P 500 or something that has both: 1) high liquidity, and 2) low volatility. This is because for those order you can be reasonably sure that the price won’t move much by the time you finish your order at your brokerage.

But…why would you want to do this even if it was liquid and not volatile? You never know how the market can change. With market orders, you can only stand to lose money. So why not just take the extra 2 seconds to throw in a limit? Consider 4 examples below:

- Example 1: Lets say a stock is at $122/share. You put in a market order. By the time your order confirms, it’s dropped to $120/share. This is great news, as you’ve just purchased your shares at $120/share.

- Example 2: A stock is at $122/share. You put in a limit order at $120/share. By the time your order confirms, it’s dropped to $120/share and you still got your shares at $120/share. In other words, you make the same money with a limit order as with a market order given you set your limits properly. And even if you set your limit to $122/share, it’s likely your order will still execute at $120/share. So you really lose nothing here.

- Example 3: A stock is at $5/share. You’re fine getting in at $5/share but can’t be bothered to put in a limit. You enter a market order. The stock price jumps to $5.65/share by the time you enter your order. You just lost $0.65/share (or instantly lost 13% of your value). If you were buying 2000 shares, you’d just lose $1,300 instantaneously.

- Example 4: A stock is at $5/share. You’re fine with getting in at $5/share, but no more. So you put in an order limit at $5/share. The share jumps to $5.65/share and your order doesn’t execute. You decide to be patient and let it drop to $5/share and don’t FOMO into the stock. If the share prices doesn’t drop, you’ll just buy something else – no big deal. In this case, you’ve saved yourself the $0.65/share (13% loss) and keep your options to buying something else that isn’t overpriced.

In other words, there’s only upsides to buying limit orders when compared to market orders. Conversely, there’s only downside with 0 upside when buying with market orders.

I highly recommend you use limit orders on all trades, even ones where you’re confident limit order price is the same as market order price. The reason for this is because you don’t want to build a habit of doing market orders and being lazy with your trades.

A Quick Note Of Caution On Doing Limit Buys On Options

Limit orders are sufficient for regular stocks, because regular stocks are generally not super volatile. And even if stocks are volatile, their volatility is nowhere near when compared to stocks.

When buying options, you must use limit orders, and I highly suggest you cross-reference limit order prices across multiple brokerages. Here’s an example of a big fat FAIL that I did:

- E-Trade quoted me $0.90/share in call options for $QRTEA.

- I bought it at a limit of $0.90/share and the order went through.

- The shares were actually worth $0.45/share and I lost half my money immediately.

This was due to a quoting error on the E-Trade website. And options are quoted incorrectly a lot of times. You should combat options pricing in 2 ways:

- Think apriori what price you’d be willing to pay/lose per share for your option. Commit to that price.

- Look at the bid-ask pricing of the option.

- Cross-check the bid-ask pricing of that option across 2-3 different sources to make sure the quotes align.

- Put a limit order in for your option, sticking to what you committed to in step 1. Alternatively, you can set a lower limit than what you committed to in step 1 if the prevailing market rate is even cheaper than what you thought. Cross-checking in step 3 makes sure that your limit order is accurate and that you won’t be overpaying for your options.

Or, better yet, just don’t buy options.

Conclusion

- Market orders are a lazy way to buy stocks and ‘let the market decide’ how much you should pay per share. Market orders are a great way to lose money. Except you won’t even get the pleasure of watching the cash curl up in a ball of flames.

- Limit orders are a sensible way to buy stocks by saying “this is the max price I will pay per share – take it or leave it.” If the market’s too expensive, your order won’t execute. If the market’s cheaper than your limit, you’d still buy the shares at market rate.

- Limit orders act as a way to protect you from wild market swings, which could cost you a ton of money.

- Limit order’s only downside is you need to take an extra second or two to enter your limit price. Other than that, it offers only upside in the form of protecting your money and allowing you to know what risks you’re taking more accurately.

In conclusion, use limit orders and never use market orders to execute trades.

PS: If you’re reading to start gambling, er, I mean, “investing” – here’s my E-Trade affiliate link here. I still have no idea what I get if I refer someone to E-Trade. But if you sign up, I’ll find out!

0 Comments

Trackbacks/Pingbacks