Want an easy way to stop throwing away hundreds of bucks a year? In this post, I’ll show you how to save money on utilities so you can put hundreds back in your pocket each year and use the extra money to pay off debt, invest it, or buy something nice for yourself.

And you might be thinking “Uhh, a few hundred bucks a year? Not worth the effort.” But what if I told you these tactics below are close to effortless, so that one-time minimal efforts can put a few extra hundred bucks in your bank account, year after year?

Assuming you live in somewhere decently expensive and you live in a 1bd/1ba, you could be saving roughly $500/yr (and more if you live in a big single family home, for example).

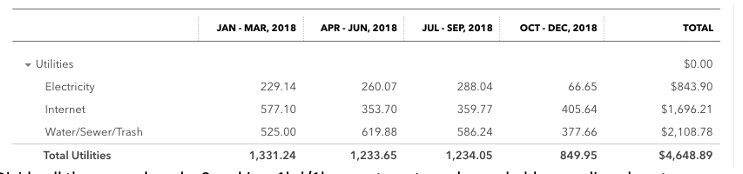

Here are the utility expenses accumulated over 3 of our Airbnb units back in 2018: one unit in San Jose, one in Mountain View, and one in Palo Alto so we can average out the utilities for a better estimate of what you can save.

Divide all those numbers by 3 and in a 1bd/1ba apartment, you’re probably spending close to:

- 843/3 = $281/yr on electricity

- 1696/3 = $565/yr on internet (probably more, actually since my internet nowadays costs $55/month)

- 2108/3 = $702/yr on water/sewer/trash. Or this is free for you if you live in an apartment that covers this for you.

- In total, this is probably about $1500/yr in utilities for a 1bd/1ba in the Bay Area

Depending on where you live, you want to do an audit of your specific numbers—remember this blog is about personal finance so the numbers will be different for everyone. Don’t just blindly accept these numbers as is! The numbers on this post is just an illustration of specifically what I’ve seen for my own costs and your costs will almost be guaranteed to be different! As a comparison though, if you live in a much less expensive area than the Bay Area but find that you’re spending $3000/yr on utilites in your 1bd/1ba, you know there’s a lot of room for you to save money on your utilities.

Keep in mind if you live in a single family home, your expenses will be much larger (which means the amount of money you can save on utilities is much larger).

Without further ado, let’s dive into the tactics.

Table Of Contents

Your Comprehensive Guide On How To Save Money On Utilities

First Way To Save: Heating/Cooling

Gotta be honest here, saving money on your heating and cooling in your 1-bedroom apartment won’t save you much compared to the other tactics. BUT if you live in a much larger home (like a 3-4 bedroom house), then you’ll probably find more value in this section.

Nest Thermostat: Bought by Google, this automatic thermostat will let you set schedules for heating and cooling so that you’ll automatically set the proper temperature at just the right time for your home’s climate. Google claims it’ll save around 10-12% on heating and roughly 15% on cooling in their promotional content.

According to the Residential Energy Consumption Survey, as of 2009, heating and cooling account for 48% of energy consumption, or roughly 48% of your bill. Since certain geography demands much more cooling than heating and vice versa, the best estimate I can do in this blog post is just to say the Nest thermostat might save you 14% of 48%, which is around 6.72% of your electricity bill.

For a 1bd/1ba it may not be worth it as it starts at $130, and 6.72% of even just a 1bd/1ba annual electricity bill of $281 is $18.88. It’ll take you roughly 7 years to get a return on your investment, and even after that you’re only pocketing 20 bucks a year. Meh.

But for a larger home, say 1200sqft, you could be looking at $245/mo in AC costs and an electric heater can cost $960 just for the winter season. Just in heating and cooling, we’re looking at 245*3 + 960 = $1695/year in heating and cooling costs. With nest then, you’ll save roughly $114/yr on a larger house (and even more if your house is more than 1200sqft – for example, in my parent’s home, the AC bill is around $300/mo).

For a 1200sqft house, you’ll get back your return on investment within 2 years and will be collecting an extra $100/yr for doing nothing. So with a larger house, a nest thermostat is definitely worth considering! Check it out here if you think it could be a right fit for you: https://amzn.to/3BGLjZK

Portable Cooling: When I was living at my parent’s house, their AC costs $300/mo when we turn on central air. The problem is that my parents don’t need AC because they like the heat. It’s just me that melts any time the weather is above 80 degrees Fahrenheit.

In fact, turning on the AC drove them crazy because it was always too cold for them. And it was expensive. So instead, I just bought a portable AC to cool down my bedroom only. The model I bought was this:

And at the time, it cost $434.91. This is no longer eligible for Prime Shipping, but you’ll probably find something similar if you went on Amazon and just searched for “Portable AC.”

It cost $434.91, but it turns out that the $300/mo bill was reduced to $150/mo with this small change. This means that within one season, I break even on this AC (3 months times $150/mo in savings). And every subsequent year, instead of using central cooling, I just use the portable AC to save $450/yr.

And to be fair, I probably picked one of the most expensive ones at the time because I wanted something that can cool my room in a heartbeat. So you can go more cost-effective by picking something cheaper and getting a return on your investment even quicker.

Your mileage may vary if you live in a smaller place.

Steal AC: This is outlandish, controversial, and probably unnecessary. It is also currently what I’m doing for the summer season because I am cheap.

Before you judge me, let me give you my current situation: my girlfriend and I split a Manhattan apartment of $4000/month. That said, we don’t want to pay a dime of utilities if we don’t have to.

“OK but how do you steal AC?” We simply open the door.

You see, in a lot of fancy apartments the hallways are already cooled with AC during the summer, and if you have a small enough apartment, you can simply open your apartment door and the cool air will go in. It takes around 45 minutes to cool down a 500sqft apartment so it’s not like you need to keep it open for the whole day.

This only works if your apartment has air conditioning in its hallways though. As this probably doesn’t apply to most people, let’s move on.

Don’t leave your windows open when operating AC / heater. This may seem fairly obvious, but homes and apartments have insulation. If you spent all the money heating or cooling your living area, you don’t want to be paying extra by having to heat up / cool down the streets as well.

Smart plugs: Recently, I purchased some smart plugs to turn off *all* electronics in home at night without having to manually turn them all off. This is mostly born out of laziness and not in an effort to save electricity. More specifically, I bought this: https://amzn.to/3rB8Iaf, and it works with my iPhone where I just scan my “Home” app to its QR code and name each plug. One each plug is named, I can just group them to a rule I call “Good night.”

Then each night before I sleep, I just say “Hey Siri, good night” and it’ll turn off all the lights, computers, and routers in the home.

You might not save too much money on utilities with this because lights, computers, and routers use miniscule amounts of electricity. But hey, it’s super convenient.

LED Light Bulbs: If you haven’t replaced your light bulbs with LED ones yet, welcome to the 21st century. These gems use 75% less energy than normal, incandescent lighting. But your savings aren’t really on the energy usage, because light bulbs aren’t really going to move the needle on your bank account.

Where LED light bulbs shine is their 25,000-hour life when compared to a normal bulb’s 1,200-hour life. As of this writing, we see that a pack of 8, 60W light bulb costs roughly $2.12/bulb and LEDs cost around $2.39/bulb (also 60W):

Since an LED bulb is expected to last 20.83 times longer than a regular bulb and their cost is about the same, per bulb, an LED bulb is going to cost you 2.12/(2.39/20.83)=18.47 times less just in material costs. And instead of changing your bulb 20.83 times, you just need to change it once.

And it saves 75% of the energy over the life of the bulb. An LED bulb costs roughly $1.50 to operate each year (depending on how your electricity is billed) and thus an incandescent bulb costs around $6 per year to operate.

Suppose you have 20 bulbs around your apartment: you’d have a savings of $4.50*20 = $90/year. Again, it’s not much but the $90/year plus a bunch of other small tactics will accumulate to a much larger sum saved per year.

Plus, buying LED light bulbs is just as inconvenient as buying regular bulbs or even CFL bulbs. The only difference is you won’t need to change LED bulbs as often.

3-Day Freedom Challenge

Sign up for this 3-day challenge to automatically save & invest your way towards financial freedom!

Second Way To Save: Water Costs

Sewer and trash are normally billed as a constant, so you won’t be able to save much there. You can toss 1 pound/month or 1 ton/month of trash in your apartment and you’re billed the same.

Turning off water while you brush your teeth: Doing this can save about 1,200 gallons of water per year. However, since water only costs $1.50 per 1000 gallons on average in the US, you’ll only save around $1.8/year.

But it’s good for the environment, so turn water off when you’re not using it!

Using low-flow showerheads: HGTV says that 175 minutes of a low-flow shower will save you 178 gallons of water. This is with the assumption that you take 25 x 7 minute showers each month (ew, you should be taking showers every day).

For me personally, my showers are like 25 minutes long each day because I like thinking in the shower, so in reality I’d probably save 25*30/175*178 = 762 gallons each month, or 9144 gallons each year. Or $13.7/year.

Keep in mind the “danger of averages” – the $1.8/year and $13.7/year would be multiplied by 3 if you’re living in New York city for example. Depending on where you are in the country, this may vary wildly.

You can save a tiny bit of money by practicing good water hygiene, but mostly it’s good for the environment.

Finally, Save Money On Natural Gas:

According to inspirecleanenergy.com, the average monthly gas bill varies wildly: from $76.55/mo on average for Washington state to $232.20/mo for Hawaii.

You’ll need to audit your own gas usage and how your utility company bills you for gas to see if the following might be useful for you.

Nest, once again, can save 10-12% on your heating costs, which means depending on where you live, you could save $5-$25/mo just using a nest thermometer.

According to Webb Supply Company, it takes 11.31 therms (1130.73 CF) to heat 1000 gallon of water (raising it by 80 degrees Fahrenheit, from 60F to 140F).

According to HGTV, I apparently love wasting water and shower way too damn much at 1885 gallons/mo, or 22620 gallons per year, which would equate to (1130.73 CF) * 22620/1000 = 25577 CF of gas. In NYC, residential natural gas is billed at $13.75/thousand square feet so per annum the gas cost could be $351.68 just in showers alone. So if you have a household of 2 people and both love wasting water like me, that’s around $700 just in heating up the water for your shower.

Low-flow showers will save 40% of water, and taking shorter showers (say 15 minutes, instead of 25 minutes) would save another 40%. Lastly, combine that with setting your water heater to 110F instead of 140F would mean there’s only a temperature delta of 50 instead of 80, saving yet another 37.5% (yes, it scales linearly). You don’t really need your water to be at 140F and 110F is plenty sufficient to be pretty hot. In total, all 3 tricks combined would mean you’d save around $351.68 – ($351.68 * 0.6 * 0.6 * 0.625) = $272.55 per person per year.

This is a significant amount of money to save on utilities just by replacing a showerhead.

3 caveats here:

- “$272.55 per person per year” is only for my specific case where I live in NYC and take 25 minute showers each day. Your mileage may vary and you need to do the math for yourself to see how much money you can save.

- You won’t save any money on utilities here if your apartment pays for your gas and water (assuming you don’t use an electric water heater).

- Setting the default water heater temperature isn’t possible for a lot of apartments, and is mostly a trick for people living in single family homes. So if you’re living in an apartment and you don’t have the option to save another 37.5%, your math looks like this instead:

$351.68 – ($351.68 * 0.6 * 0.6) = $225.07 saved per person per year.

So How Much Money Can You Save On Utilities Each Year?

Again, this will vary for you. But for my particular situation, here’s a breakdown of how much money I could be saving a year on utilities if I optimized my costs:

| Technique | Savings Per Year |

|---|---|

| Nest (electricity) | $50/yr (about 600sqft). Both our heating and cooling are through electricity so nest won’t save us on gas. |

| Portable AC | Not applicable for me anymore since I live in a much smaller place now. |

| Stealing AC | $0/yr. This is more to feel good about my expensive rent. |

| LED Bulbs | $45/yr (about 10 bulbs in my apartment) |

| Low Flow Showerheads (Water) | $0/yr on strict water costs, since our apartment covers it. But if I had to pay for water, it would save an additional $80/yr (we’re 2 people and each would cost roughly $40/yr). |

| Nest (gas) | $0/yr since our heater is electric. |

| Low Flow Showerheads & Taking Shorter Showers (Gas) | $450/yr (we are 2 people). |

| TOTAL | $545 |

3-Day Freedom Challenge

Sign up for this 3-day challenge to automatically save & invest your way towards financial freedom!

So in my particular situation, combining all of the above applicable tactics will help us pocket $545 extra per year (or $625/yr if our apartment stopped covering water costs for some reason).

“But isn’t this a lot of work just to get $500/yr?” NO!

If you look at each of the tactics, a lot of these are just one and done:

- Nest is installed once.

- Getting a portable AC requires you to buy it once.

- Stealing AC is just leaving your door open (this is less work than normal since you’d close your door normally!)

- LED Bulbs requires only a single purchase – 25,000 hours lifecycle means you’d only buy new bulbs once every 3 years if the bulbs were never turned off. Realistically, you’d replace these once a decade.

- Low flow showerheads – this is a single purchase.

- Taking shorter showers – this is high effort, and if it isn’t worth it for you to take 15 minute showers instead of 25 minute showers, you’ll at least understand the monetary tradeoffs.

In conclusion, most of the work involved to save money on your utilities comes from doing the math. After you’ve done the math, getting that few hundred extra bucks every single year is fairly passive. Keep in mind that depending on how many people you have, how big your home is, and where you live will have huge affects on the calculations above, so please do the math to see what levers you can pull to passively add a few hundred bucks back to your account each year!

Yes, math is hard, but it all boils down to this question:

“If someone promised to pay you $500/yr until you die in exchange for doing one hour of math (not one hour every year – just one hour, period), would you do it?”

Exercise for the reader: if you were to save $500/yr for doing an hour of math, and you have another 50 years left to live, what’s your hourly rate from doing that math?

(this post contains affiliate links, where I get paid if you buy stuff through my links so I can keep running this site)

P.S.: This is a new blog and if you’ve found this helpful at all, it would mean the world to me if you were to share this post to someone that you think this post might benefit. It would also be immensely helpful to me if you could give me any feedback on the content at hello@goodmoneygoodlife.com

3-Day Freedom Challenge

Sign up for this 3-day challenge to automatically save & invest your way towards financial freedom!

0 Comments

Trackbacks/Pingbacks