Learn how to save money for retirement in this post. I’ll show you some very simple math and equations you can plug in. Plug it in and you’ll know how much you can save.

Later in the post, I’ll address some uncomfortable situations that almost nobody talks about. Namely: what if you’re too late to the game and can’t physically save enough?

Table Of Contents

How Much Money Do You Need For Retirement?

I don’t know – it depends on when you retire. Namely, you need to know the following variables for you to calculate how much money you need to save for retirement:

- Your age now.

- How much money do you have now?

- The age you want to stop working.

- The age you think you’ll die.

- How much money will you spend each year in retirement (in today’s money)?

- How much average inflation each year from the time you retire to the time you die?

That’s it. Just know these 5 variables and you can easily plug formulas in the next section to know how much to save each year.

Formulas For How Much Money To Save For Retirement

There’s 2 approaches: a conservative one and a more aggressive one.

Very Conservative Approach

Let’s start with the most conservative one. Which is: you’ll assume your returns are a wash with inflation. So your money growth and the growth of the market is the exact same.

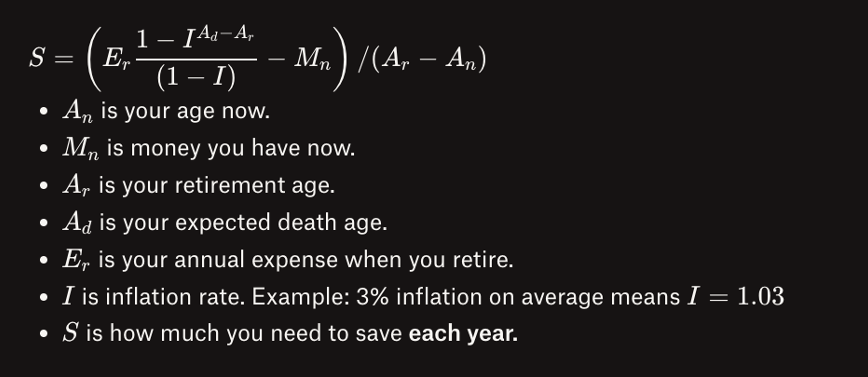

In this case, the formula is just:

Basically:

- Take your annual retirement expense and multiply it by a geometric series term that represents the sum of inflation compounding over the years.

- Subtract that term (total you’ll spend from retirement to death, at retirement money’s terms) by the money you’ve got now.

- That difference gives you how much money you’ll need to save for retirement.

- Divide by that number by the number of years from now to retirement.

- Hence, you need to save that much annually.

Example, if I’m:

- 33

- Have 800K

- Want to retire at 50.

- Think I’ll die at 90.

- Annual expense of $100K when I retire.

- Inflation of 3%.

Yields: (100000 * (1-1.03^(40))/(1-1.03) – 800000) / (17) = $397K/yr needs to be saved.

Tweak the annual retirement expense to $30K/yr and you only need to save $86K/yr.

This formula is ultra-conservative. As it says that you can’t beat inflation with your investments.

A More Reasonable Approach: How Much Money To Save For Retirement With The 4% Rule?

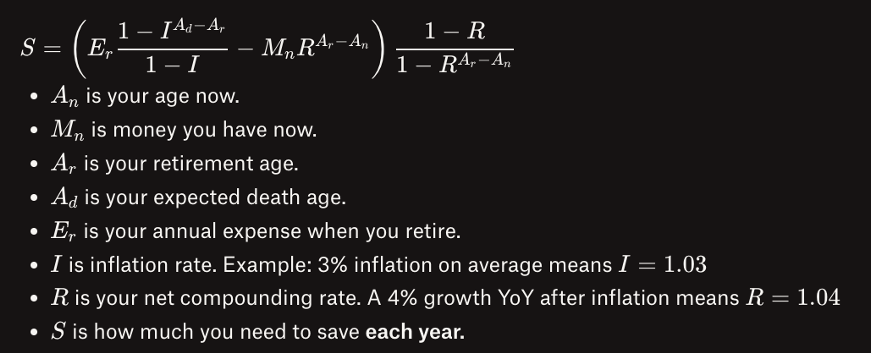

Here, you make the assumption that you gain net of 4%/yr. This can be roughly derived via the assumptions that 1) inflation is 3%/yr and 2) average returns are 7% gain each year. Hence, you get 4%/yr in gains.

Same example:

- 33

- Have 800K

- Want to retire at 50.

- Think I’ll die at 90.

- Annual expense of $100K when I retire.

- Inflation of 3%.

- Rate of return per year is 4%.

Yields: (100000 * (1-1.03^(90–50))/(1-1.03) – 800000*(1.04^(50–33))) * (1-1.04)/(1-1.04^(50–33)) = $253K/yr needs to be saved.

Looks hard to plug-in and use? I’ll make it really easy for you. Just copy/paste this to Google “(100000 * (1-1.03^(90–50))/(1-1.03) – 800000*(1.04^(50–33))) * (1-1.04)/(1-1.04^(50–33))” and press ‘enter’. Then, substitute the bolded values with your own amounts. It’s easier than you think because a lot of terms are repeated.

Likewise, if I tweak the annual retirement expense to 30k, I only need to save $30K/yr instead.

Assuming a 4% tailwind, this result is huge. Compare the 86K/yr vs 30K/yr, and imagine the difficulty of the former vs. the latter. And also compare having to save $397K/yr vs. $253K/yr. The former might imply making an extra $280K/yr in annual income than the latter (due to taxes).

Which one of these models you’d like to use to estimate how much money you need to save for retirement is up to you.

What If You Can’t Save Enough?

It’s possible you can’t save enough for retirement. If you look at the above calculations, saving $397K/yr is pretty much impossible for most. Nobody talks about this, but this is a reality you must understand!

If you can’t save enough, there’s a few things you can do:

- Push your retirement date back, OR

- Earn more money.

If you’re 64 and have 1 year left to retire and expect to die when you’re 75. You can’t save $1 million for a $100K/yr burn rate if you make $20K/yr. You need to make more money, OR you need to work til you die.

Now suppose you can save enough, but you want to retire faster. Then you need to either 1) save more money, or 2) make more money. If you’re already saving as much as you can, then you need to make more money. By definition, it’s not physically possible for you to save more money – so the extra money must come from somewhere. Just make the money – there are plenty of side hustles / earning opportunities you can read about on this blog.

Objection: “If anyone can just make money out of thin air, everyone would be doing it. It can’t be that easy!”

Answer: It’s definitely not that easy. It’s actually really hard to make money. But attempting for upside is better than not. The former gives you a chance to win; the latter doesn’t. As Machiavelli says:

Develop the strength to do bold things, not the strength to suffer.

You’ve got one life. Don’t suffer an unexamined life where you spend most of it being a wage slave and “waiting” for retirement. Do something about it.

How To Actually Save Money For Retirement?

Great, all the math’s good. And you know how much to save each year. How do you actually save money for retirement?

I recommend automatically transferring part of your paycheck (i.e. your target savings per year divided by number of times you get paid each year) – to a savings account or a brokerage account you NEVER EVER touch. That is, you can directly transfer, say $1K of your $1.5K paycheck to Vanguard and auto-invest it. I show you how to automate your way to wealth like this with our 3-day guide below. It’ll show you step by step with screenshots on how to get everything automated so you don’t have to manually ‘save money’ each month:

Wrapping It Up

The most important thing as far as how to save money for retirement is the math. Without the math, you won’t know how much to save. And if you don’t know how much to save, it won’t matter if you know how to save money.

There has to be a goalpost so you know if you’re saving not enough, just right, or if you’ve got a surplus.

Use formulas above to figure out how much to save annually (and hence, each paycheck).

And as far as the mechanics of how to physically save money for retirement – that’s easy. Simply automate your savings so you don’t have to think about it. For detailed guidance on how to do this, just sign up for the 3-day email bite-sized guide to show you how to do that (per above, or below). No spam, we promise.

PS: All human comments will be approved basically. But there is a comment approval procedure because there’s tons of bots that try and spam the comment section. Approvals are done within 24 hours generally.

PPS: Any questions/concerns/thoughts you don’t want to share in comments below? Shoot me a message hello@goodmoneygoodlife.com. I’ll generally reply with a thoughtful response within 2-3 days.

0 Comments