In this post, I’ll show you whether annual fee credit cards are worth their weight in fees or if you should just stick with no-fee cards. I’ll also show you my favorite free credit cards to use, as well as my favorite annual fee cards.

At the end of the day, you’ll have to decide for yourself if each of these cards are worth it or not based on what perks you’d like.

Hopefully, this post will help showcase why I use each card and how each card fits in different aspects of my life.

O – show them if annual fee credit cards are worth it or not. Will run through a few cards that I personally use and work for me. You’ll need to decide of these are worth it for you based on what your living habits are.

Caveats On Welcome Bonuses

Credit card points are great. You can redeem them for massive value on travel and other rewards.

Here’s some things to keep in mind with these sign up offers and welcome bonuses. For the summaries below, keep in mind sign-up bonuses and perks change a lot over time with these cards. Double check these to make sure that the bonus is worth your time.

Another thing to consider is you shouldn’t try to apply to 10 different credit cards in a year to squeeze 6-figure points left and right. There’s 2 main reasons for this:

- Some banks, like Chase, have a 524 rule where you can’t open 5 or more credit cards within 24 months. Thus, if you’re going to open 5 credits in the next 2 years they really should align with your lifestyle the best and provide the best long-term value for you.

- Opening way too many credit cards will lower your average age of credit. While the average age of credit isn’t the most determining factor in your credit score, constant hard credit pulls and a low average age of credit will be detrimental to your credit score. This is a negative feedback loop since a lower credit score = it’ll be hard for you to get more new cards in the future.

Free Credit Cards That I Use

Here’s some cards with no annual fees that I use. I highly recommend these as they’re essentially free money.

American Express Blue Cash Everyday

This card I love because it has an actual useful feature: 3% cash back on groceries.

Because I have an Amex Gold Business card (that I’ll talk more about below), I can transfer these points to an airline or hotel as opposed to being forced to just take cash back.

Here’s some of the features for Amex Blue Cash Everyday:

- Current welcome offer: Get 20% back on amazon purchases up to $150 (15k points) back for first 6 months. Also, get $100 (10k points) back if you spend $2k on first 6 months of membership.

- 2% cash back for gas.

- 2% cash back for select department stores.

- 3% cash back for groceries, up to $6,000/yr (or 18,000 points). This isn’t a ton of points, but 3% cash back on a free card for something that can be used on a daily basis is unheard of. And if you want to save money, you should be buying groceries anyway. But no worries if you like burning cash, I’ll talk about cards that give bonus points at restaurants as well.

Chase Freedom Flex

Chase Freedom flex is an awesome card, and while I like saying things like “you should decide what works best for you” – if you don’t have this card, stop reading this right now and get it here.

This card is free and its benefits are insane, and is up there with premium cards.

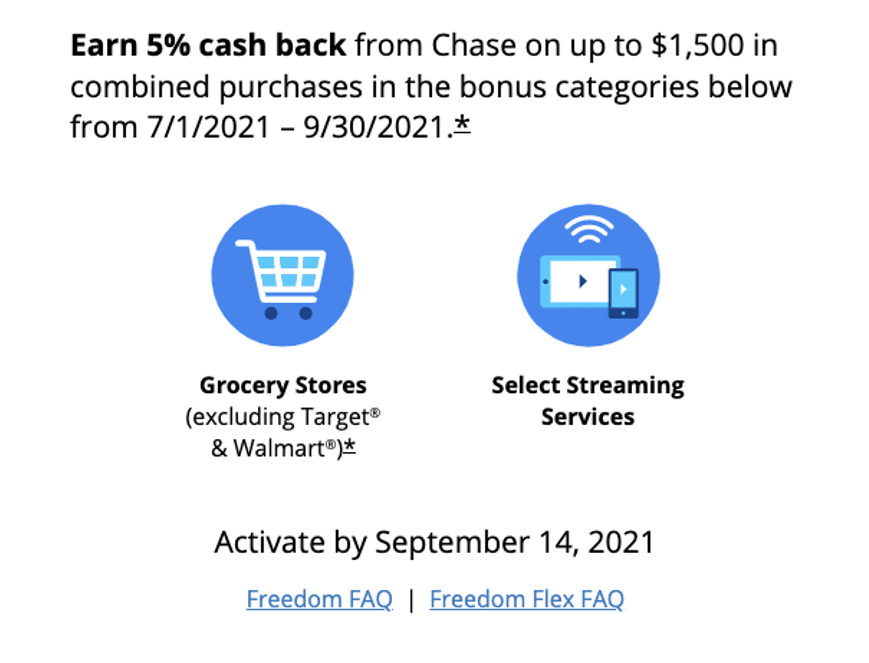

First, there’s the 5% cash back categories that rotate every quarter. 5X points is insane for a free credit card and this is the only free credit card that’ll give you 5X points (as far as I know).

Each quarter, there’s 2 or 3 categories that you can get 5% back on. Normally, at least one of the categories are useful the other categories are more obscure. Here’s what I mean:

Groceries are useful for everyone and 5X back on that trumps the Amex cash card (only 3X points). On the flip side, I don’t stream anything so it’s not super useful for me.

Other times, they’d give you 5X points back for gas for one category, and the rest of the categories aren’t useful. Here’s a list of their rewards history from thepointsguy so you can get a better feel of what kinds of categories they’ll reward you for. It’s rare that they’ll have no categories that’ll be useful for you in any given quarter, but it does happen sometimes.

Fear not though, the 5% cash back is only one of the ridiculous perks of this card. Other insane features include:

- Welcome offer: Get $200 back (20k points) when you spend $500 on the first 3 months of account opening.

- 5% on travel purchased through the Chase portal. This usually isn’t super worth it though since they’re a lot more expensive than buying directly from airlines a lot of the times.

- 3% back dining at restaurants, including takeout and some delivery services. This is insane. First, 3% back is unheard of for free cards. Second, 3% back on something as commonly used as restaurants is insane! You used to only be able to get this by paying a hefty annual fee for the Chase Sapphire Reserve card. Now you can get this for free! Crazy jealous of people that’s just getting in the credit card game that can take advantage of this while I wasted tons of money on annual fee credit cards just for this perk.

- 3% back on drugstores.

This is hands down, the best free credit card out there.

Chase Ink Business Cash

This is a fairly situational card. Let me explain this card’s features and why it works for me.

First, because this is a business credit card, you may need to have a business checking account, or an LLC, or sole proprietor documentation to qualify. You may not. It depends on the bank’s mood I find. You can also just start a business checking account with Chase and they’ll throw this card in for free. After you get the card, you can just cancel the business checking account.

Here are the perks:

- Welcome offer: $750 cash back

- 5% cash back up to $25K spent on office supply stores, or internet cable services.

- 2% cash back at restaurants and gas stations (up to another $25K).

I don’t really use the restaurant perk because I have Flex Freedom and some of the other cards below that I’ll discuss.

But why this works for me: I used to run an Airbnb business where Comcast would charge us $100/mo/unit, and we had a bunch of units. So I’d rack up on the order of 5000 points per month for doing nothing.

The second reason why this works for me is because I use Amazon to buy groceries and a lot of other things. With the Staples-Amazon hack you can do with this card, you can turn every dollar you spent on Amazon to a 5X points back situation. Which is huge since the limit is $25K (or 125K points).

If you feel you pay a lot for internet services or if you use Amazon a lot—and you don’t mind the potential hassle for qualifying for the card—you can apply for this free card here.

Credit Cards With An Annual Fee

These cards might not be for everyone since they have an annual fee attached to them. And they’re hefty. Only sign up for the cards below if you feel you can generate a value bigger than the fee!

Chase Sapphire Reserve

This used to be the grand-daddy of all credit cards. This card used to be the talk of every single personal finance blog. And even though I’m incentivized to get you to sign up for this so I can get extra points, I’ll have to be honest here: this card has less appeal over time like Amex Platinum, Chase Flex Freedom, or Chase Sapphire Preferred could be better choices. But for now, this card still works for me as I want to rack up a lot of travel points with Chase.

Here’s the perks for this card:

- Welcome offer: Spend $4,000 within 3 months of account opening and get 60,000 points.

- $300 annual travel credit. For example, if you spend $400 on an airplane ticket, they’ll give you back $300 right away. For Amex Platinum and other cards, they might only give you back money if it’s an auxiliary airline fee like checking in extra bags, etc. But nope, Chase will just give you $300 back for any travel-related expenses, including public transport or Uber/Lyft. This is huge because it cuts down on the annual fee by a lot.

- 3X points worldwide on restaurants. Chase freedom flex has it now so this is less impressive. But if you’re going to get this card anyway, you might as well enjoy this perk so you don’t always have to remember to swap cards when going out.

- 50% more redemption value when booking directly through Chase portal. To be honest, this perk is “meh.” You’re likely to get a much better deal for luxury products like business/first class by transferring your points directly to the airlines and then purchasing there.

- Doordash rebate of $60 in statement credits and $0 delivery if you sign up by 2021.

- $120 rebate on a Peloton membership through 2021.

- 10X points on Lyft rides (normally 3X). This is an enormous deal because 10X points is ridiculous. A roundtrip to the airport is like 2000 points in NYC. That’s insane! But this perk might not be worth it during times when Uber is half of Lyft’s price though.

- 1 year complimentary Lyft Pink membership that’ll let you have up to 15% off your car rides.

- Priority Pass: Which lets you use airport lounges no matter where you go. The main downside of this is 1) not all airports in all terminals will have it (i.e. SFO), and 2) priority pass lounges really suck in the US. Priority pass lounges are much better and less crowded internationally.

- Global entry, which lets you get through TSA very quickly if you fly domestic. The TSA-Pre line lets you get through security without taking out your electronics or taking your shoes off. And instead of the super invasive microwave thing where they can see your genitals, it’s just a metal X-ray. Basically TSA-pre is like getting through airport security pre-9/11. For domestic travel, you can bypass super long customs lines when you return to the USA. This is especially great after an 11 hour flight when you don’t want to spend another 2 hours in customs.

- Rental car upgrades and insurance. Just say “no” at the rental counter when they upsell you insurance.

- Lost luggage reimbursement.

- Travel accident insurance.

- Other bonuses that they rotate throughout COVID. For example, they used to have 6 months’ free of Spotify.

- No international transaction fees.

- Tons more bonuses and details here.

This credit card does come with a hefty $550 annual fee though. It used to be around $100 less, which is why I say this card is “less worth it, but still worth it” nowadays for me.

First, with the $300 travel credit back, I’m realistically only paying $250 a year for this card. I’m willing to pay $250/yr for global entry + TSA Pre + all the travel assurances + 10X Lyft points + any other rotating perks that they’re promoting because I can justify the value being above $250/yr for all the perks. And to be honest, this is a ridiculously long list of perks even for an annual fee credit card.

But your situation might not be the same. Instead, you may want to consider Chase Sapphire Preferred (Reserve’s little brother), where the perks still exist, but at a lower magnitude. Compare them here to see if any of the Chase Sapphire products work for you.

American Express Gold Business Card – My Favorite Annual Fee Credit Card

This is another one of those annual fee credit cards, except this one is a business credit card as well.

This card is a lot simpler but its perks are still amazing. The reason is because they offer 4X points for very useful things.

Here’s how this card works:

- Welcome bonus: Spend $10K in the first 3 months = get 85K points.

- 4X points on the 2 categories below where you spend the most money, each billing period:

- Airfare purchased directly from airlines. This is incredible because 4X points on something as expensive as airfare means you could rack up points really quickly.

- Advertising. I use this the most and ads are one of the most expensive parts of my e-commerce business. I view this as “free points” because as long as I’m earning money in the business, the ad expense are covered. And the more my business grows = more ad money spent = more points. And as expensive as ads are, I get 4X points on an expense I need for my business anyway. That’s insane.

- Gas stations, restaurants, and shipping. I didn’t know this had 4X points on restaurants until I did research for this. I think I’ll start using this card now for restaurants.

- No international transaction fees.

For my particular business situation, this card is worth the $295 annual fee for me. This card also lets you transfer points to Amex travel partners, which is basically most of the airlines you can think of. It may not be worth it for you if you don’t do a lot of advertising or pay for a lot of airfare. Do your research to see if this card makes sense at $295/yr.

By the way, just because you might need an LLC or business checking account to be able to get one of these cards, doesn’t mean each transaction needs to be business-related. For example, it’s quite feasible your business “didn’t work out” and you just keep this business credit card and use it all for personal expenses.

For example, I’ve closed down business checking accounts with Chase before since I had to shut down the business and they encouraged me to keep the business credit card. And they said I can just use it for whatever I want.

One last note: I used to use Chase Ink Business Preferred as they provide 3X points on their ads, but I found that Amex Gold is better for me. Grab it here if you’re interested.

You may consider Chase Ink Business Preferred if your business does spend some money on advertising, but the additional points (3X vs 4X) won’t be enough to justify the difference in the credit cards’ annual fees ($95 vs $295).

What Annual Fee Credit Cards Work For You?

There’s a ton of other credit cards out there, but the purpose of this post is to show you the main ones I actually use, and the ones that people talk about the most often.

And to be honest, these credit cards have one of the best benefits I’ve seen after looking at a ton of different credit card reward programs.

That said, you should still do your own research to see if there’s some other cards that are a better fit for you. As an example in this post, you can see I use different cards for a different aspect of my life:

- Amex Gold Business for my e-commerce business.

- Chase Sapphire Reserve for restaurants and travel / public transport.

- Amex Blue Cash Everyday for groceries.

- Chase Ink Cash to get 5X points on Amazon and for any and all cable services.

- Chase Flex Freedom for eating out and also rotating categories like gas or groceries.

As such, you should find out which credit cards are best suited for different areas of your life. Once you piece together that puzzle you can make it so that most of your purchases will net you 3-5X points.

It’s basically free money, because you’ll spend money on whatever you’ll spend it on anyway, so why not maximize your points and cash back for it?

P.S: If this article has helped you in anyway, please share it with someone who’d be interested in learning about credit card points!

PPS: If you happen to sign up to a credit card using my links, I’ll get credit card points.

0 Comments

Trackbacks/Pingbacks