In this post, I’ll go over a few cryptocurrencies I’m looking at. Please don’t take this post as a “what crypto to buy” kind of a post. This piece is purely my opinion and my goal is informational only.

As such, please do your own research and know this isn’t financial advice. Listening to me for investment advice is probably slightly worse than putting your entire life savings on black at the roulette table.

Also know that crypto is super-ultra volatile, so when you buy it you should under the risks first. And the risk is that you’ll very likely lose 100% of your value.

With those disclaimers out of the way, I’ll go through a few coins and talk about my opinion on them.

The King Of Coins: Bitcoin

I would say the OG, Bitcoin, is not worth buying. At the time of writing, it’s already at $44K.

The upside seems limited because even if it goes up to $200K, you’d only 5X your money. That sounds ridiculous, doesn’t it – “only 5X your money”? But keep in mind that these asset classes are ultra risky so it’s reasonable to expect a higher return.

For example, seasoned crypto investors don’t panic buy or sell if the coin goes +/-50%. Extreme volatility in highly speculated currencies is par for the course.

With such limited upside, I just don’t find Bitcoin worth the risk at the moment.

On top of that, I’m not aware of any economic backbone for BTC once Tesla stopped taken BTC payments. Thus, with Bitcoin you just have a highly speculative coin with no real value to back it.

“Pure speculation” has been story since Bitcoin’s inception, so what’s the big deal? The problem with Bitcoin is that there are much more viable coins that are candidates for growth, which I’ll go through in the rest of the post.

Think of BTC as the crypto of MySpace – it’s first but I don’t think it’ll be the last.

My vote: would not buy this crypto.

Ethereum

I like Ethereum because I think it’s heavily underpriced currently. Its current market cap is $350bn but I think having a market cap of 10T isn’t that ridiculous.

“Well, Microsoft has 2 trillion, why do you think this can beat a well-established company’s market cap?” This logic makes sense if Ethereum is a company. But it’s a currency, so such logic doesn’t apply here.

Ergo, I feel like ETH can still 10-30X.

And unlike BTC, there’s some economic backbone for this currency in the form of NFTs. Check out this post explaining what NFTs are if you’re unfamiliar.

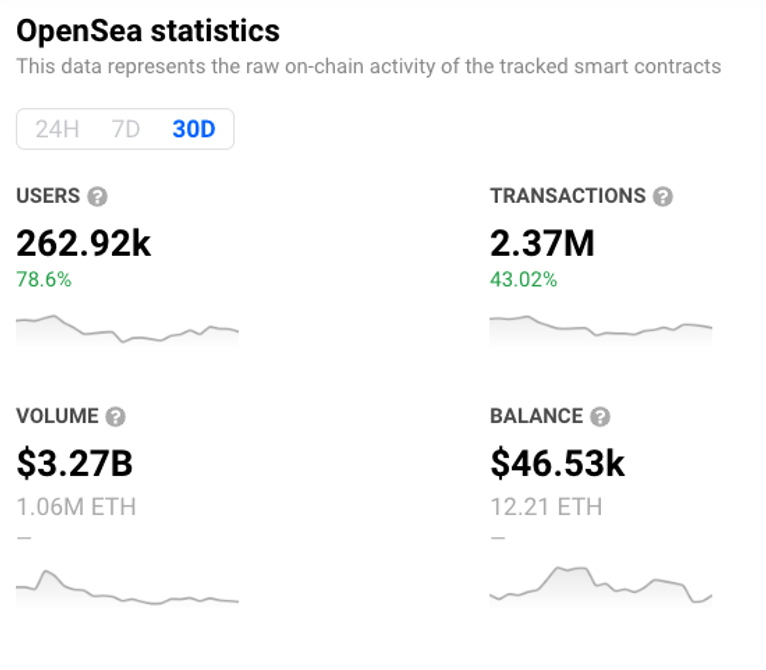

There are multiple platforms to trade ETH-powered artwork popping up left and right already. And if we look at the most popular platform, OpenSea, we see that it has done $3.27Bn in trading volume in the past 30 days.

Keep in mind NFTs are still super early in the game, and that’s why I think ETH still has plenty of room to go up.

The vast majority of NFTs are speculative in nature. So you might think “the economic backing of this speculative asset…are more speculative assets? Isn’t that just a Ponzi scheme?”

To this, I’d answer “yes, and also no.” Most NFTs are highly speculative but there’s some NFTs with fundamental value. For example:

- Some NFTs allow their owners early access to merch drops (i.e. Adam Bomb Squad’s project). This has real value because people generally buy their streetwear to flip. If you can consistently buy the hoodie to flip for an extra $300 because you’re at the front of the line, that produces real value. In this case, the NFT gives you a lot of opportunity to flip a popular streetwear brand’s clothes. That’s fundamental value.

- Some NFTs allow you to participate in exclusive events. Event organizers probably pay in fiat to organize these events. Thus, access to these events is linking an ETH-based purchased to a real event whose expenses are driven by fiat. Instead of just “owning a .jpeg” your NFTs can get you exclusive access to events. That’s value.

- Some NFTs like Bored Ape Yacht Club (BAYC) that are highly successful, will gift the owners new NFTs. That is, owning the BAYC is literally printing money for them because they can just sell these new “airdropped” assets for pure profit. And since BAYC is one of the “OG” projects, any secondary projects they make will be worth a lot. In these cases, it’s a mixture between speculation (i.e. their secondary projects are profitable due to hype) and not (proven track record of creating and selling very expensive NFTs, selling on Christie’s, Sotheby’s, etc). On the one hand, you’re sure to make a profit because you’re printing money. On the other hand, it’s still a Ponzi scheme as each NFT still doesn’t have any economic value other than selling more NFTs. But hey, that’s art.

I’m quite bullish on ETH and I’d recommend this crypto as a “buy.”

It has some competitors which could be dangerous for the coin long-term, but I’d say in the current atmosphere, ETH looks healthy to me.

Alt Crypto To Buy: Cardano

As of writing, Cardno (ADA) is worth $2.25 per coin. It has a fully diluted market cap of $100Bn. “Fully diluted market cap” just means if all the coins were available and mined, it’d be worth $100Bn.

A market cap of $1 trillion would mean a 10X return, which isn’t super unreasonable.

The bull case: Cardano also has an economic backbone, but it’s a lot less developed than ETH. And another huge win for ADA compared to ETH is that their transaction fees are really, really good. As an example:

- Minting an ADA NFT costs me about 1 ADA ($2.25) in fees. Minting an ETH NFT can cost up to 1 ETH ($3K) depending on gas prices. These fees are of no value. Ergo, there’s a huge potential for people migrating out of the ETH ecosystem to the ADA ecosystem. People are incentivized to save up to $3K per transaction.

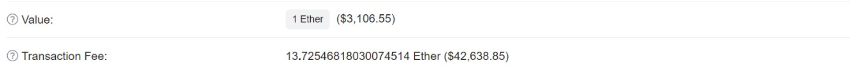

- Times released an NFT a couple days ago, and here’s one of the transaction’s fees for one of the transactions. They bought $3.1K worth of goods and the Ethereum blockchain charged them $42K. Anyone with half a brain would be hugely incentivized to move out of ETH.

Another good thing about ADA is “smart contracts” just came out for it recently. “Smart contracts” just means users can now very easily buy ADA-based NFTs without having to explicitly go through escrow. Thus, ADA NFTs will behave more and more like ETH NFTs over time (except without insane fees).

Lastly, ADA is still very early, so there’s still a lot of room to run win for early adopters.

The bear case: ADA NFTs are much less proven than ETH NFTs. As of this writing, their smart contract only came out like a week or 2 ago. Thus, ADA’s “economic backbone” of NFTs has a lot more risk associated with it (but more rewards for early adopters). And without a good economic backbone, there’s no intrinsic value to support the coin.

The other thing that makes me squeamish about ADA is there’s no NFT project there that’s as legendary as CryptoPunks or BAYC, nor will they ever. Even if there’s a great ADA-based project, it’ll never be considered as an “OG” project. The reason’s because ADA NFTs will forever go out in the history books as coming out much later than ETH NFTs. An NFT project can be the “first” in the ADA blockchain, but it’ll never have the esteem to be “one of the first NFT projects, ever.”

The final, and biggest risk of ADA is that ETH is projected to lower their fees drastically in Q1 2022. Ergo, they might price out ADA fails to get enough traction by then. Remember, ADA’s main advantage over ETH is that their transaction fees are very low, and ETH’s transaction fees are ludicrously high. Once ETH solves that problem, ADA could become obsolete.

I’d recommend an “okay-ish buy” for this crypto – I wouldn’t ape into it though.

Solana

Funny story, I almost fell for a scam when someone DM’d me that if I send a wallet address X amount of SOL, I’d get back 300 SOL.

I went through the stage of buying some SOL for $40 and thought “…nah.”

It’s now at $141.59. It’s got a fully diluted market cap of $72Bn as of this writing and ergo a 13X return if it reaches $1 trillion.

It also has an economic backbone in the form of NFTs, though it’s relatively new.

The one good leg-up SOL has against ADA is their team. SOL came out with a smart contract much quicker than ADA, and Solana is a newer coin. ADA, on the other hand has had a ton of delays in releasing their smart contracts.

There’s some Solana NFT projects that are getting noise already, and are gaining much quicker traction than ADA NFTs. For example, one of these stupid apes sold for $1.1M already:

My recommendation is: “I’d probably buy this crypto a little bit more than ADA.”

I personally don’t hold nearly enough SOL and I feel like I’m going to convince myself to buy a lot more soon.

Wrapping Up

Keep in mind these are just my musings as of Sept, 2021 for various crypto coins to buy and what to avoid.

Again, this is not financial advice and I’m known to not predict the future (surprise).

Please do your own research and don’t base any buying decisions on some idiot online talking coins.

Full disclaimer of positions:

- I hold positions in ADA, ETH, and SOL.

- I no longer hold positions in BTC.

0 Comments