There’ll come a point in your business (hopefully) where you’re “moving product.” In order to “move” product, you need to either buy or make the product which’ll cost you money. Working capital bridges the gap between your buying the product to selling it for a profit. In business lingo, a “net 30” means you can pay your supplier 30 days after you’ve ordered the product. This gives you 30 days to sell the product for a profit (and in turn pay back your supplier).

This net 30 is a type of working capital and is crucial for any business that wants to grow quickly. The reason for this is because it takes time to buy/make the product and get it over to your warehouse. If you don’t have any capital to fund the buying process, you’ll need to wait until you sell out your inventory before you purchase new inventory.

In other words, without working capital, your business will have these long gaps between bursts of sales which will make your business hard to sustain (especially if it’s a new business with a small warchest).

The problem is: not all suppliers offer working capital, and net 30 isn’t going to be available just because you ask for it.

In this post, I’m going to show you how to use an American Express business credit card to create your own net 30 so you’ll never have to rely on the whims of suppliers for your working capital (and for the survival of your business).

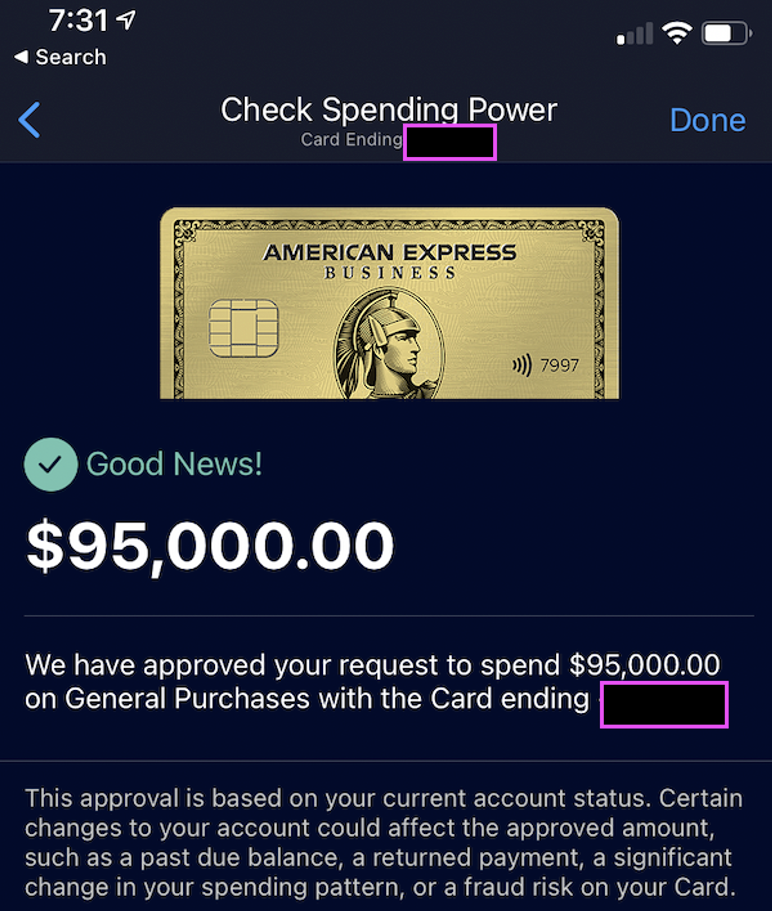

As an example, I only spend a couple thousand a month on my credit card but my line of credit has about $95K should I ever need it:

A credit card is considered a net 30 since you’ll have a month to pay back whatever you charge your card.

What Cards Should I Use To Make A Net 30 For My Business, And Why?

First, grab an amex gold card here. If the gold card isn’t for you, feel free to do this with other Amex cards that offers no preset spending limit, since they’re more generous with their credit lines than Chase. Other Amex cards with no spending limits are: Platinum, Green, Plum, and Black. If you have the latter though, you probably don’t need to be reading this blog.

What does “no preset spending limit” mean? All it means is that you won’t have to call your credit card every time you want your credit line increased. As an example, to expand your credit line with a Chase Freedom card, you’ll have to call Chase to get it increased.

With these cards from, your credit line gets increased automatically. And they get increased without a hard pull on your credit.

But “no preset spending limit” actually does mean you have a spending limit, it’s just more flexible.

As an example, when I got my Amex Business Gold card, I only had $3K in spending power. This means I can’t make any purchases that exceed $3K with my card.

OK, so why use these cards?

Because while your spending power might very small to start, it grows very quickly when you know how to hack it. You can start with a credit line of $3K and secure a $90K net 30 for your business within a few months.

How To Create A Net 30: Amex’s Infinite Money Glitch

The fastest way to pump up your spending power is to spend a lot, and pay it off immediately.

You can even pay your card ahead of time before you use the credit, so you can signal to the algorithm that “yes, I can spend a lot of money and afford to do it.” As an example, if your credit limit is $3K, but you “pay off” your card by putting $8K in, you’ll have a balance of -$5K. Now, you can charge your credit card $5K and your balance is back at 0 (leaving you another $3K to spend).

It takes a few months of doing this, but you’ll find that your spending limit will quickly skyrocket.

How it worked for me: I used to pay $3K-$10K/mo in rent for my Airbnb business with this card. I would pay off this card the same day so the algorithm that calculates my spending power will see that there’s a LOT of churn, but $0 debt. After 3 months, my spending limit went up to $90K even though I never spent more than $10K each month.

I haven’t paid $3K-$10K/mo rent with this card for a long time. My monthly expenses with hits card is closer to $1K/mo. Still though, my spending power hasn’t decreased and has actually increased to $95K.

How Do I Spent A Lot Of Money? I Don’t Have Any!

This is the chicken or the egg question. After all, if you can’t spend money, you won’t be able to boost your spending limit. Without a high spending limit, you’re not going to have an effective net 30.

There’s a few tricks to this.

First, have sufficient money when you start your business. You don’t have to have enough to support a net 30 at scale, but you should have enough for your first couple shipments. This way, by the time your business is expanding fast, you’ve already built up that track record with your own cash with Amex to have a higher spending limit.

Second, you should throw all your expenses to this card. Throw all your business expenses, from all your businesses at this card. Have personal expenses? Use it on this card too!

If your friends aren’t point-hoarders like mine are, ask them if you can use this card to buy them stuff and have them Venmo you back.

But when you use this trick, be sure to do really good bookkeeping so you can separate business expenses from personal expenses. Personal expenses should be paid off using a personal checking account, and business expenses should be paid off by their respective business checking accounts. If you don’t do this, you could pay a lot of money in penalties, not to mention you’ll no longer have a corporate veil.

Finally, once you’ve done the 2 tricks above, check your spending limit everyday until it’s where you want it to be. How it works is you ask Amex: “Do I have a spending limit of $50000?” and they’ll tell you “yes” or “no.”

Unfortunately, they won’t just tell you what your spending limit is so it’s kind of a guessing game.

And since you can only check your spending limit 3 times a day for security reasons, I recommend you start low, and then then double that number until Amex won’t let you check anymore (or say it’s too much). The next day, you can just continue guessing starting with a number higher than your highest approved spending.

Example: If you guessed $2000, $4000, and $8000 and got rejected on $8000 – the next day you might start at $6000 and see if it is approved. If “yes” then check $7000, if “no” then check $5000. This is just the bisection method if you’re a nerd.

Why check your spending limit / net 30 everyday? Because once your spending limit is close to where you’d like to be, you want to ease off your excessive spending and stop all the accounting magic.

The sooner you simplify the accounting, the less headaches you’ll have bookkeeping. There’s no need to keep boosting your net 30 if it’s sufficient, so continuing to do so is just adding extra work to your business which you don’t need.

And when you’ve got to the spending limit that satisfies you: congrats, you’ve just secured a robust net 30 for your business!

A Word Of Caution

Here’s a warning for net 30.

Just because you can spend $100K/mo doesn’t mean you should.

A net 30 is a great business tool if you’re 100% sure you can move enough product to pay off the debt. A net 30 will help you smooth out the financial gaps in your business and help you grow your business much faster.

But only if you can pay off your debt each month.

For example, if you’re confident you can move 100 units this month at $100 a piece, go ahead and purchase $10K of inventory. At the end of the month, you’ll pay off your debt and have extra inventory sitting at your warehouse (assuming you run a rational business that charges customers more than what it costs you to get inventory).

Don’t let the temptation of scaling fast make you too aggressive. And don’t let the fact that you’re approved for a huge amount trick your ego into thinking you can take extremely unnecessary risks and get away with it.

As an example: If you’re not sure you can sell 100 units at $100 a piece (since you only did 10 sales last month) and you’re approved for $50K, don’t spend $50K buying inventory. You’ll likely end up in debt with an extremely high APR by the end of the month. This is bad.

At the end of the day, debt is debt. It doesn’t matter how Amex markets it. Whether they call it “line of credit” or “no preset spending limit” – it’s all the same: if you don’t pay off your debt by the end of the month, you’re going to eat 14%-22% APR. That’s lights out for your business.

That said, having a net 30 way more than what your business needs currently is a great thing as it gives you some flexibility to grow in the coming quarters. You can take all the extra time/effort you would have used raising capital and direct it towards making your business better instead.

0 Comments

Trackbacks/Pingbacks