In this post, I’ll give a quick overview and review of Mint vs Personal Capital. Read about their similarities, limitations, and which one I prefer personally.

Mint vs Personal Capital: What Do They Do?

Both Mint and Personal Capital help track your finances. And they both work kind of the same. You:

- Sign up for an account.

- Connect your Mint (or Personal Capital) account to your financial accounts.

- They’ll show you a financial dashboard, tracking your income / expenses / investments / cash.

Both “work” in these respects, but you probably don’t want to use both as it’s annoying to have to juggle 2 accounts that do mostly similar things. So let’s dig into what exactly the differences are between the two platforms and you can decide for yourself whether you’d like to use Personal Capital vs Mint.

The Difference Between Personal Capital vs Mint: Investing

Personal Capital tries to upsell you financial advising services. As a result, they have more features when it comes to analyzing your investments. Whereas Mint will show you which stocks and funds you own if you dig deeper, Personal Capital will show you exactly how much you’ve allocated to certain types of investments. For example, it might show you that you’re 20% international bonds, 10% US bonds, 40% cash, and the rest in US stocks.

It also has a built-in fee analyzer so you can see how fees eat away your returns throughout the lifetime of your investment. Mint doesn’t have such a feature, as far as I’m aware.

Thus, Personal Capital is great for those that really want to get all the nitty gritty details of their investments in one single account.

For me personally, I don’t like using Personal Capital for their investment tools. This is because I mostly trade on E-Trade and Vanguard and am a long-term investor. Most brokerages provide the same feature set as Personal Capital as far as investment analysis goes, so it’s not a huge pain point for me to have to see it on Personal Capital. So for me a lot of these “trading” or “investment” analytics are useless for me. I just glance at my net worth once in a while and I’m good.

How Does Mint Work?

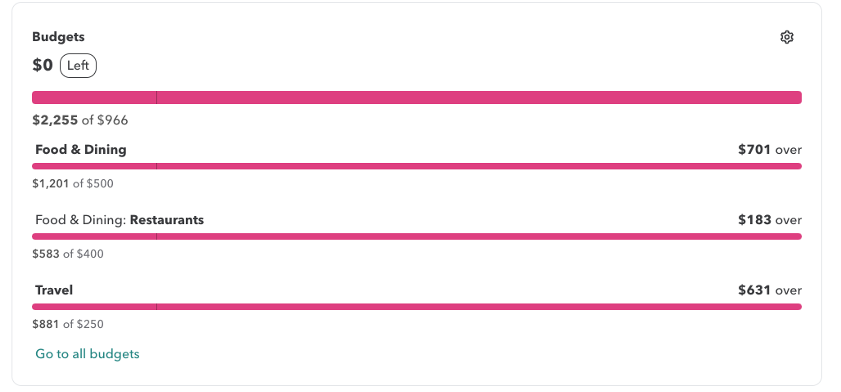

Mint makes its money by referring you to credit cards and other financial goodies. As a result, they have more features when it comes to things like setting budgeting goals. Whereas Personal Capital will show you what your expenses are, you can create goals for your budget in Mint like so:

Damn, I’m a bad spender.

And while Mint tells you what stocks you’re invested in and your bigger movers are (like below), they don’t really tell you what “sectors” you’re invested in and how diversified you are.

Damn, I’m a bad investor.

Which One Should You Use?

Personal Capital is for you if:

- You really care about exactly where your money’s allocated, in terms of sectors.

- You want all the nitty-gritty details of all your investments in one place, instead of using your native brokerages to look at the investment metrics.

- You’re the type of investor that invests in sectors, but somehow will need to re-balance your portfolio frequently enough that looking at your allocation is an important feature to you.

Mint is for you if:

- You’re OK not having all the bells and whistles of Personal Capital for investments.

- You’re more expense focused than investment performance focused.

- You’re indifferent between either the budgeting vs investment features (this is me, and I explain why I use Mint below).

- You don’t need to dig into every single detail, all the time and you’re OK looking at your trends.

Mint vs Personal Capital: Which One I Prefer

I personally prefer Mint because I don’t really care about the nitty-gritty details of my investments that’s presented in Personal Capital; I’m just not that kind of an investor.

Second, while Mint allows you to dive deep into your expenses and lets you look at every single transaction: I don’t care about that much granularity in my expenses either.

For me, I just use these platforms to get an overarching views of these trends:

- Net worth

- Income / Cash Flow

- Expenses

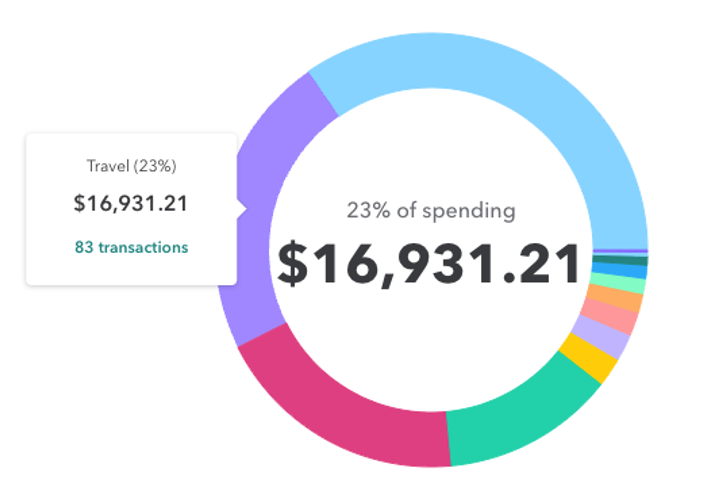

If I see a spike in expenses, I’ll just look at the “trends” in Mint to see what category I’m spending the most on. Then, I’ll just deploy the 80/20 rule to see if I can just cut out 2-3 expensive meals to drop my spending significantly. And that’s it. What I don’t do is try to penny-pinch in 100% of my spending scenarios: I just focus on my top spending category (which Mint presents, like below) and see if there’s a low-hanging fruit I can cut expense on to save a ton of money.

As an example above, I might see how I can spend less in travel next time (my highest spending category, next to investments, which I count as ‘spending’ for some reason). Food & Dining also accounts for 19% of my spending, so there’s probably an 80/20 there to take advantage of as well.

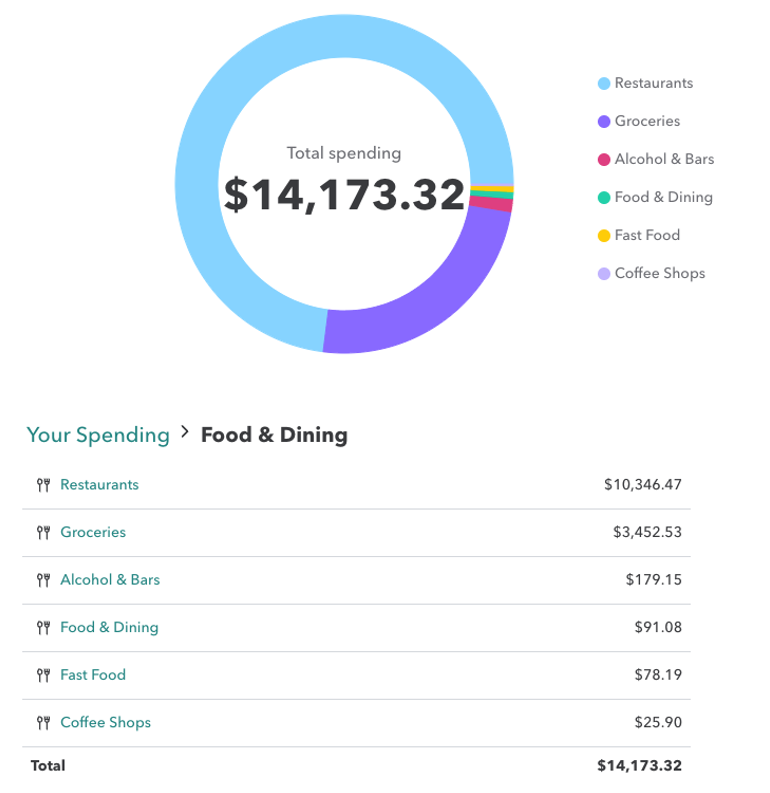

Diving deeper into this example, I spent $14K on food & dining in the past 12 months.

Clicking “restaurants” and sorting by most to least expensive, I have 27 (of 215) transactions that are above $100. This accounts for $3.7K of my $14K food & dining spending. This means that if I just cut my top ~15% of most expensive restaurant spendings, I save $3.7K/yr on food & dining already.

And because I just look at high-level trends to cut expenses, I don’t really need Personal Capital for its investment features. Likewise, I don’t really need most of Mint’s features.

So why do I prefer Mint then?

- I find the UI much cleaner and less overwhelming than Personal Capital. Personal Capital throws a lot of things at you just on the opening screen, whereas Mint just shows you a nice, quick overview.

- It’s a lot more reliable for me. Other folks say that Personal Capital is more reliable for them, but this just isn’t true for me. An example is Wells Fargo: Mint doesn’t really have an issue with them, but Personal Capital seems to never be able to log onto Wells Fargo for more than a day or two at a time, if at all.

Because I personally prefer not to drive myself insane with all the tiny details of my spending and prefer to look at high level trends that both platforms provide, the most important thing for me is how easy is the platform to use. And for me, Mint is much easier to use than Personal Capital.

Whether you’re on the budgeting end or the investing end, below is a free guide (no spam, we promise!) on how to use Mint in conjunction with a few other tools to no just save, but invest on autopilot so that you can automate your way to wealth.

I also prefer Mint–plus nobody calls me trying to become my financial advisor as with Personal Capital. I do use both for different purposes though. Both valuable tools.

Haha that’s so true I forgot about those persistent calls when I first signed up years ago.