In this post, I’ll show you how to increase your credit score quickly and I’ll show you the exact ways I increased my credit score from a 690 to a 815 in 3 months.

Increase your credit score is useful because a great credit score means organizations like banks and care dealers are more confident in lending you money. The more confidence they have in you actually paying them back a loan means the better loan terms you’ll get. And for gigantic purchases like a house, a couple percent saved can translate to 10s of thousands, if not 100s of thousands of dollars over the course of your loan.

In other words, these simple tricks I’m about to show you can save you 10s of thousands of dollars.

Also, having a 800+ credit score means you can flex on your friends that are less financially responsible.

80/20 Rule To Quickly Increase Your Credit Score

I’m a huge believer in minimal effort, maximum results. So, instead of digging into the weeds with 100s of different techniques and tricks, we’ll just do 20% of the work to get our credit score 80% of the way there.

Less work = more speed = the quicker you can increase your credit score.

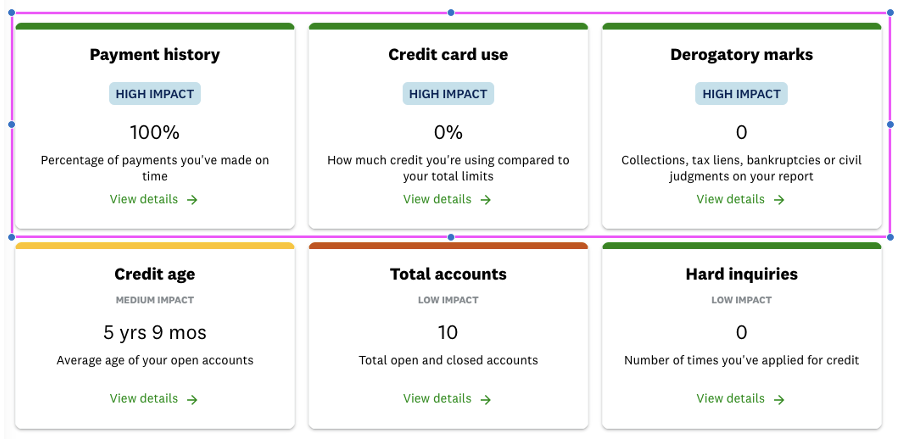

Looking at Credit Karma or Mint, you’ll find 3 things are high impact: payment history, your credit card use (expense ratio), and derogatory remarks.

Let’s break down a few easy ways you can optimize for these 3 categories so you can enjoy a fast increase in your credit score.

First, Create A Great Payment History

Pay your bills on time. Nothing scares creditors more than if you have a history of not paying your bills. So obviously, your payment history is one of the highest impact (and easiest things) you can do to increase your credit score.

Live below your means and plan out your expenses each month. This is basic financial responsibility but in order to pay on time, every time, you must make sure you don’t spend more than what you can earn.

In other words, use your credit card like a debit card and never owe any debt.

Once you’ve figured out your finances and know how to live below your means, all you need to do is to go into your credit card’s website and setup autopay each month to pay the balance in full. Don’t have the autopay pay the minimum, as this will incur interest and actually count as debt against you.

You most definitely want to set up autopay for your credit cards because it guards against having to remember to pay off your cards each month. You might have many cards and if you only forget paying off 1 card, for 1 month, your credit score can decrease drastically.

If you’re not confident you can live below your means, or that you’ll have enough in your bank account at the end of the month, then don’t set up autopay yet.

You’ll have to figure out how to live below your means first, and then try to increase your credit score. You can’t “fake” a good credit score while being financially irresponsible. If you can’t live below your means, you have no hope of a good credit score anyway (nor should you be buying a house, since you’ll get foreclosed on).

Second, Reducing Your Expense Ratio / Credit Card Use [Best Way To Increase Your Credit Score Quickly]

If a credit card gives you $10,000 and you use up $10,000 every single month, they’ll consider this as “risky” spending vs. someone who only uses $500/mo. The more risky you look to creditors, the lower your score will be.

There’s 2 ways to reduce your credit card usage (no, you don’t have to cut back your spending).

First, Pay Off Your Debts *Twice* A month

In the screenshot above, you’ll see that my credit card use is 0%.

Does this mean I spend $0/mo on my credit card? Hell to the no. I use my credit card every single day. So how is it $0/mo?

Simple: I pay my credit card off every 2 weeks instead of once a month. If you pay your credit card off once a month, they’ll just look at what’s due at the end of the month and count that towards your credit card use / expense ratio.

But if you’re proactive and pay off your card twice a month, by the time your bill is due, they’ll see that nothing is due (since you’ve paid this month already) and conclude that you’re a customer that’s not using credit.

If you do this, you’ll have 0% credit card use while paying off your debts (i.e. your payment history will be at 100%). The combination of these 2 means that creditors will love you as they feel like it’s virtually guaranteed you’ll pay them back money they lend you.

Just paying off your bills on time and this trick is enough to increase your credit score very quickly.

But what happens if you forget to pay your card twice a month? No worries, this next trick will help mitigate your credit card use even if you forget.

Increase Your Credit Limit While Spending The Same Amount Of Money Each Month

Before I discovered the trick of paying off my credit card debts twice a month, I used to do this trick.

The trick is simple: call up your credit card and increase your credit limit. Personally, I recommend increasing your limit 20-30% each time, once to twice a year. If you’ve had a credit for a while, you can try to increase it by 80-100% the first time around. For example, I was able to increase mine by 100% for my Chase Freedom card the first time I did it since I never asked for an increase in the 7 years I had the card.

So how does this trick work?

If you spend $1k/mo and your credit line is $10k, your expense ratio is 10%. If you called up your credit card and increased your credit line to $20k and still spend only $1k/mo, your expense ratio is now 5%. That is, you’re still spending the same amount of money, but with one phone call all of a sudden you’re a “lower credit risk” and your credit score will increase quickly because of it.

My Recommendation To Quickly Increasing Your Credit Score

I recommend you combine both tricks: 1) increasing your credit limit while 2) paying off your card twice a month.

The first reason for this is because in some months money might be tight and you can’t pay twice a month. Your paycheck might come in a day later or a day earlier and it might just be easier to pay once for that month.

The second reason is in some months you might forget to pay twice a month. In these cases, you’ll fall back to your automatic payment (covered in the “Payment History” section above). This is great as you won’t get dinged for a late payment.

But we can do even better. If you had increased your credit line and forgot to pay off your card twice a month, your credit card usage would still be lower than if you didn’t combine these 2 strategies together.

Derogatory Remarks

This is super easy to do. Just make sure to be a Lannister and pay off your debts.

Pay off your medical bills, Comcast, Netflix, etc.

As long as you pay off your debts and don’t owe people money, you’re good to go.

Most subscriptions and services have automatic payments where they can charge your credit card on a monthly basis (welcome to the 21st century). I highly recommend you set up autopay for these vendors so you accidentally forget to pay $5 and incur a 50 point decrease in your credit score.

Minimal Work To Quickly Increase Your Credit Score

If you nail these 3 categories:

- Payment history: pay your credit cards on time by setting up autopay for them.

- Credit card usage / expense ratio minimization: Increase your credit limit while keeping the same expenses, and pay off your credit card twice a month.

- No derogatory remarks: Don’t owe Comcast $2 and get a Experian ding that’ll cause your credit score to dip 50 points. Set up autopay for your subscriptions and don’t pay them manually, since there’s a lot of them and it’s hard to juggle them all.

You’ll skyrocket your credit score surprisingly fast.

As a personal example: I’ve never had a late payment (i.e. a 100% on-time payment history and 0 derogatory remarks) but my credit card usage was a bit high. As a result, my credit score was only 690 even though I was doing everything else right.

By simply combining the 2 tricks I mentioned above in the “Reducing Your Expense Ratio / Credit Card Use” section, my credit score increased quickly: at a pace of ~100 a month until I hit 815.

And I have a feeling I can max out my score to 850 by working on the other minor categories as well. However, I’m an 80/20 kind of guy. If I can get 80% of the way there by doing minimal effort, I won’t bother doing 5X extra work just to get an extra +35 on my credit score.

Also, with all that extra effort to boost my credit score from 815 to 850 is kind of pointless since I won’t get better loan terms at 850 vs. 815. The only real benefit are bragging rights which isn’t worth all the extra work for me (though you’re welcome to try)!

PS: If you know anyone that can benefit this information, I’d be deeply grateful if you shared it with them as this would help grow this new blog.

0 Comments

Trackbacks/Pingbacks