In this post, I’ll show you how a sophisticated investor like myself (lol jk) got scammed by a cryptocurrency Ponzi scheme, and how I lost -$21K.

How I Got Sucked In A Crypto Ponzi Scheme

On Monday March 11, 2019, I was taking a dump when a real estate investor friend messaged me to join a crypto scheme that was netting him 5%/day, and will give returns of 150% in 30 days.

I just replied, “lol” because it was obviously a scam, and I was busy looking through Instagram as you do while taking a dump. And I would show you the text messages as well, but unfortunately I used “Messages By Google” and I’m on an iPhone now, so it’s all lost.

Later, he called me about how great the opportunity was and how he has been playing around with it for a few weeks already before he pinged me. He didn’t want to just refer me to this cryptocurrency program ponzi scheme because he didn’t know if it was a scam – now that he’s got most of his money back, it was all of a sudden definitely not a scam.

Still skeptical, he told me that “quant guys” can easily yield these results. And his reasoning was that crypto is still a fairly new market and so quant guys can beat retail crypto investors and it’s like “taking money from a baby.”

I remember all these details viscerally because what’s about to happen was devastating.

Here’s a red flag I didn’t think about and/or ignored: If someone was so good at trading crypto that they were getting 150%/mo, why would they ever need to raise capital to trade even more? That makes no sense to me.

So with all these red flags, I naturally said “sure, I’ll gamble on this.”

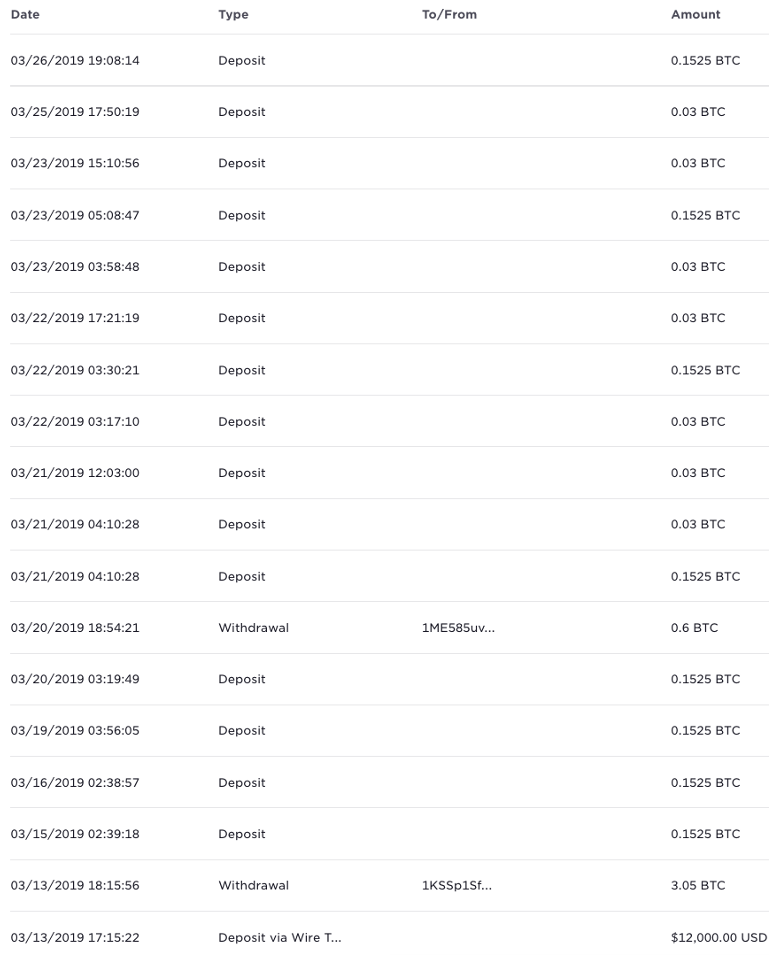

2 days later, on Wednesday March 13, 2019, I wired $12K into my Gemini account and bought 3.05 BTC and transferred it to the scammer’s wallet.

I namely went with it because this guy seemed smart. I met him at a real estate syndication get-together where pretty much only accredited investors can join. He used to be a finance guy and have done a fair amount of real estate, and enjoyed early retirement. He had all the things that I wanted for myself.

Another lesson learned: Referrals don’t mean anything. A sample size of 1, and their results for a short period of time, is not grounds for a good referral. You must do due diligence for everything. Referrals are not a shortcut to making an investment decision. Blind trust was what got me scammed by this cryptocurrency Ponzi scheme.

How These Scams Work

So how these cryptocurrency ponzi schemes work is they simply don’t pay you back. I never actually thought about this as a possibility because that’d be too brazen and it seems like they’d just go to prison for that. Instead, the courts just order them to pay victims back and don’t enforce it (at least, I haven’t gotten my money back).

Thus, if you think you’re somehow protected from fraud because “the law” will be laid down at some point…nope, the courts are not that efficient.

But anyway, to continue my story: On Wednesday, March 13, 2019 I wired $12K into my gemini account, and then sent it over to the scam’s wallet (I’ll attach the full history of transactions below):

I’m supposed to be paid out 5% of my investment on March 14th, but they claimed that they couldn’t trade due to “solar flares.” This had me worried because as soon as I put money in, they weren’t able to pay out.

Had I just lost $12,000 (BTC was like $4K at the time)?

Not yet, it seems, because they paid 5% out on March 15th and March 16th. But on March 17th, they couldn’t pay out because they were “hacked by Russians.”

Now, I got really worried. I called them the next day and their phone number just went straight to voicemail. I called them a few more times, and yep, straight to voicemail.

Anyway, payments resumed on March 19th and 20th – and now, they were running a new promotion: any new money put in will have a 10%/day return for 30 days.

Having only been paid out 4 of the past 7 days, and without an actual customer service rep, things were going horrendously.

So naturally, I re-“invested” back 0.6 BTC so I could get scammed even more.

But in all seriousness, at this point in time, I think I googled what a Ponzi scheme was and realized this was more of a game of musical chairs.

Being paid out only 20% of my original investment, I’d need to wait 16 more days until I get return of my capital. And at this point, I didn’t care about a return on my capital; I only cared about getting my money back.

So my calculation was like this: if I did nothing, then it would take 16 days to get my money back. If I put in 0.6 BTC back into the system, it would take around 14.35 (15, rounded up) days to get my money back.

I had no idea how to estimate the probability of when the music would stop. But I did hear anecdotes from my real estate investor friend that this scheme’s been going on for 9 months, so it failing within the next 14 days seemed not super likely.

But then again, my real estate investor “friend” is probably a part of the this cryptocurrency Ponzi scheme and isn’t really a reliable witness.

Too bad the payouts only lasted 4 more days after that and in total there was only 7 days of payouts over the course of 13 days. The whole scheme ended, there were no more payouts, and the site now looks like this:

Attached here is the list of transactions.

I Got Lucky

I got lucky because at the end of the day, I did get 1.43BTC back, or 46% of my initial capital back.

So my bet paid off. If I did nothing and did not re-“invest,” the 7 days of payouts would have only paid me back 35% of my money, or 1.06BTC.

And then I got really lucky because the BTC skyrocketed to $12K, where I sold. So I actually got some money back. I bought back in at $10K/USD and panic-sold when it crashed again from $60K to $33K.

So actually, I lost around -21K (double negative), meaning I actually gained money from this whole ordeal.

You could make the argument that I could have just invested $12K in 2019 when it was $4K and then sold at $33K and walked away with $99K. Except I don’t agree with this argument because I wasn’t looking to invest into crypto at all. It’s only because of this scam that I invested in the first place. So there was 0 chance I would have made a $99K without serendipidiously running into this scam.

But I still made a really bad decision, despite the result. And I do not recommend anyone investing in anything that smells remotely suspicious.

Winning poker player Annie Duke, in her book Thinking In Bets: Making Smarter Decisions When You Don’t Have All The Facts (phenomenal read; easily one of my top 10 books) call it “resulting” when you think your strategy is good solely based on the results.

It’s obvious I made a dumb decision here. You could make the argument that ‘if you get in early, then you can make a quick buck’ – but it’s impossible to time these things and you’ll most likely lose all your money. In a Ponzi scheme, the house always wins because there’s no way the operator would actively pay you and lose money on their end – their goal is to commit fraud and take as much money as they can.

So despite the result, I took an L.

And just because I made 20K, I only made 20K because the market happened to go my way. This is no indication that I made a good decision at all.

In fact, investing in a cryptocurrency Ponzi scheme is kind of like playing 2-7 offsuit in poker – statistically the worst hand. You win once with a 2-7 offsuit and now you use it as a north star to say “let me forevermore use 2-7 as my ‘lucky’ cards and go all-in.” Following that strategy will lose you way more money than however much you made initially.

All this to say, if I had kept investing in very high-risk things like Ponzi scheme, I could have easily wiped out my accidental 20K gain.

Just because it worked once won’t mean it’d work again. This result is a sample size of one, which means it’s pretty useless.

Main lesson: If you get lucky on an investment, don’t get full of yourself. It is most likely just luck. Keep doing the due diligence and think critically to see if there’s an actual, long-term sustainable investment strategy here or if it’s just degenerate gambling.

My favorite Reddit board Wall Street Bets often sums this lesson up perfectly: “the first one’s free.”

P.S.: This is a new blog and if you’ve found this helpful at all, it would mean the world to me if you were to share this post to someone that you think this post might benefit. It would also be immensely helpful to me if you could give me any feedback on the content at hello@goodmoneygoodlife.com

Could have been an expensive lesson, but I’m glad it worked out well for you!

Searched the company and found this. Apparently they weren’t properly registered and the CFTC found them guilty of fraud and arranged for repayment of $14.8M to people who were defrauded: https://www.pymnts.com/blockchain/bitcoin/2021/bitcoin-daily-court-orders-circle-society-corp-and-founder-to-pay-32-million-over-crypto-fraud-chinese-blockchain-firm-exec-accused-of-embezzling-45-million-bitcoin-rises-to-61000/

Might be worth checking out whether that’s still available!

Yeah the guy got a judgment a while back but he just ignored the orders to pay people back (he probably spent it on private jets or something). I got very lucky and walked away just less profitable as opposed to actually losing 21k like my clickbaity title suggests. There’s a telegram group chasing him down for money — I should probably check it again to see if there are updates…would be nice to get 2 extra BTC back lol.

Ugh…not a surprising move for a fraudster. *rolls eyes*

Like I said, I’m glad things worked out well for you. At least you’re up a little bit on the deal; better than a lot of folks, I’m sure!