In this post, I’ll show you the bookkeeping software that works for me and my 6-figure e-commerce business. Bookkeeping is one of the most important aspects for any business. A lot of motivational quotes on Instagram will say things like ‘done is better than perfect’ or don’t get stuck in ‘analysis paralysis.’ This is fine and all, but has the unintentional affect of having entrepreneurs being short-sighted and ignoring things that are important, but not urgent to do.

Bookkeeping is extremely important, but it isn’t urgent. But you have to do it, because numbers are the most important part of your business (and probably the only part that matters to be honest).

Without bookkeeping and a good PNL to look at, how do you know which direction your business is going in? How do you know what you’re spending too much on? Too little on?

How do you know if you’re going to wake up tomorrow with a Ferrari or homeless?

Answer: you don’t. You’re just ‘playing it by ear’ when you don’t do accounting.

So what’s the best accounting software to do bookkeeping? For my situation, it’s Xero. For you, it might be different, so let me run through the differences between Freshbooks, Quickbooks Online, and Xero and why I chose Xero for me.

Best Bookkeeping Software: Xero vs. Freshbooks vs. Quickbooks

I don’t really need that much functionality on my e-commerce bookkeeping. All I’m looking for is something that can:

- Connect to my bank and credit card accounts so I can reconcile transactions each month

- Allow me to categorize things so I can easily do my taxes at the end of the year

- Look at PNLs so I know where I’m spending the most / least on, and where I’m getting the most bang for my buck

- Let me split costs between different people for each transaction, as I have different partners and clients depending on the line item.

Pricing:

As of writing this, Quickbooks Online (QBO) costs $25/mo, Xero costs $11/mo, and Freshbooks costs $15/mo.

They each have some promotions (like 50% off the first 3 months with Xero and QBO, and 50% off first 6 months for Freshbooks) as of today, but these promotions can change everyday so the costs I included above are just the long-term costs of using each accounting software.

Functionality:

| Features | QBO | Freshbooks | Xero |

|---|---|---|---|

| Bank account / credit count connection and reconciliation | Yes. | Yes, but see Note 1. | Yes. |

| Custom categories for expenses | Yes. | Yes. | Yes. |

| PNL reports | Yes. | Yes. | Yes. |

| Split costs between various partners and clients | Yes. | No. See note 2. | Yes. |

Note 1: According to this Freshbook link: https://bit.ly/36JxP19, they use 3rd party vendors like Plaid and Yodlee (never heard of Yodlee) to import your expenses. So while technically Freshbooks does support this feature, it doesn’t seem native and seems a bit annoying and unstable to have third-party software manage your connections to Freshbooks. If an integration doesn’t work, you can’t really talk to Freshbooks and it seems like you’d be kind of stuck.

Note 2: You can rebill clients for an amount that you expensed. For example, if you did some media buying for a client and want to bill them 90% of the ad costs, you can. But since Freshbooks is built more for consultants with clients, the splitting of costs isn’t as straightforward as QBO or Xero. In QBO or Xero, you simply just split the costs by any arbitrary amount between multiple parties (can be more than 2 people). To split a bill between 3-5 people in Freshbooks, you’ll need to send 2-4 “rebills” to 2-4 different people, which is a mess.

For me, since both Xero and QBO do what I need and Xero is much cheaper, I picked Xero. And each of the 4 items above is easy enough to do for me that I wouldn’t pay more for QBO (I’ve used QBO for my Airbnb Arbitrage business, and that’s pretty straightforward as well).

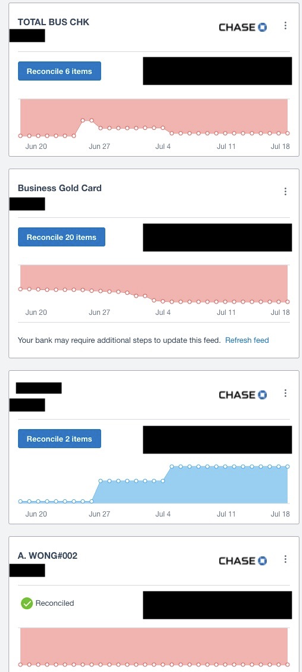

For example, I’ve connected a bunch of cards and bank accounts connected to my Xero and it looks like this:

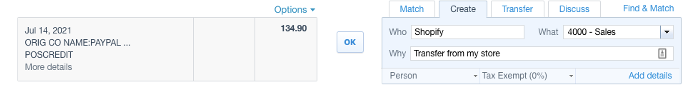

And I can categorize each of my transactions however I’d like:

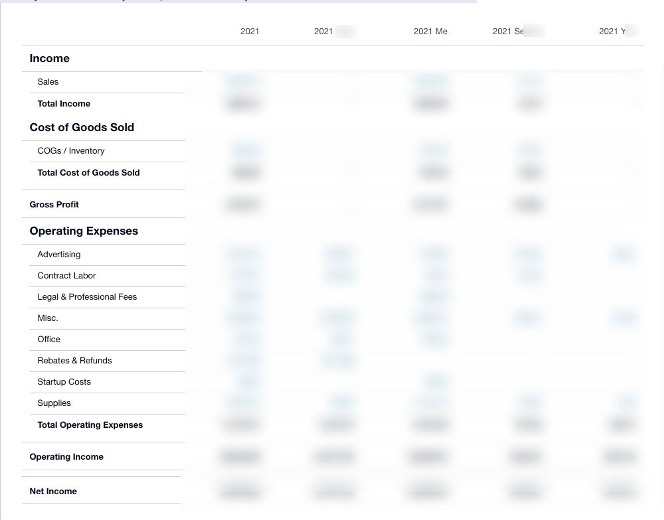

Easily run PNL reports, with each partner on a different column:

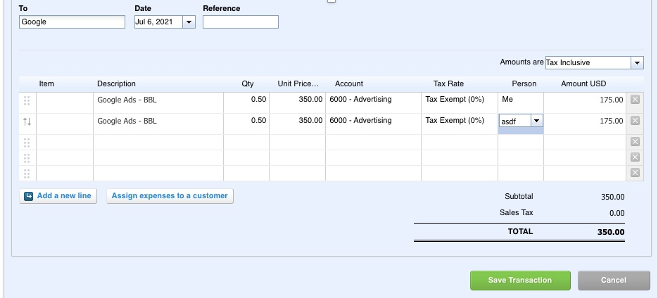

And I can split costs easily:

The Best Bookkeeping Software Might Be Different For You

Know that accounting and bookkeeping will make or break your business, because if you don’t know where you’re spending and getting your money, it’s unlikely you really understand your business.

For me, Xero works for my E-commerce business because it has everything I need for a small business:

- Auto-importing line items to reconcile.

- Letting me categorize my expenses and income however I’d like so taxes are easier.

- Allowing me to split costs among multiple people so it’s much easier to keep track of who I owe money to and who owes me money, and by how much.

- PNL reports that I can customize so I have a bird’s eye view of my business that I can dive into at any time I want.

But keep in mind while Xero is the best bookkeeping software for me, it may not be the best for you. This blog is about personal finance, and so you’ll need to find the best accounting software that works for you.

P.S.: This is a new blog and if you’ve found this helpful at all, it would mean the world to me if you were to share this post to someone that you think this post might benefit. It would also be immensely helpful to me if you could give me any feedback on the content at hello@goodmoneygoodlife.com

0 Comments