One of the most expensive things we spend money on is food. And if you’re already saving by not eating out that much, the only thing left to save on food is groceries. In this post, I’ll show you 5 ways to save money on your groceries without having to shop for near-expired foods or buy crappy foods and sacrifice your health.

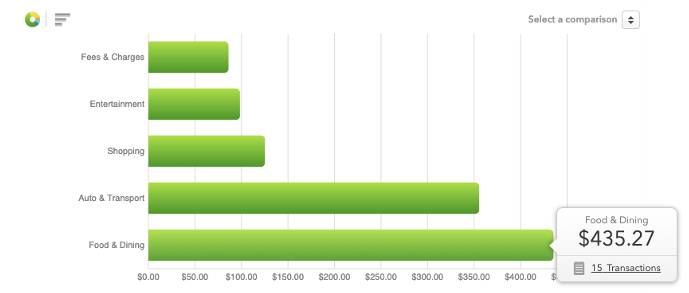

Let’s dive into a food cost example. Below are non-fixed costs of my spending in the past 14 days (fixed costs are things like rent, gas, insurance, etc. where you won’t be able to save too much and are just monthly costs you must incur):

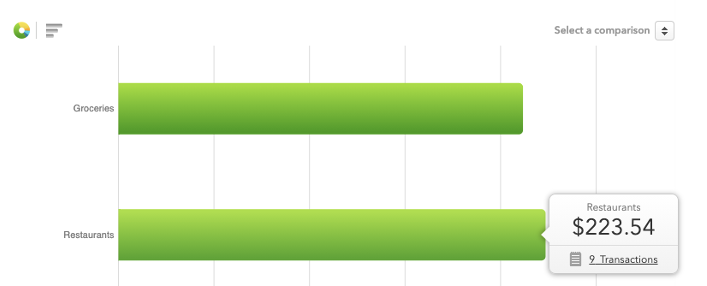

Lets dive in a bit more in this food & dining category:

I spent $211.73 over 6 transactions on groceries. Each transaction can feed me for a couple days. Each restaurant transaction can only feed me for one meal. This means:

- $211.73 in groceries good for my food budget for 12 days.

- $223.54 in restaurant food is good for 3 days worth of food, or roughly 4 times more expensive than if I were to cook for myself.

With a $435.27 on food over 14 days, I’m on a trajectory to spend $435.27*30/14 = $932.72 in any given month. For maximum efficiency, I’d be spending 100% of my money on groceries, which would cost around $453.71 over 30 days.

So just by not eating out for a month, I’d have $932.72-$453.71=$479.01 in savings!

Let’s dive into the nuances of this a bit more though. If you don’t eat out, how will you have a social life? And further, nobody wants to be a hermit for their entire year just for ~$5700 in savings.

The good news is saving money isn’t binary!

I’m spending 50% on groceries and 50% on restaurants because I’m comfortable with that. But you can easily allocate your money however you’d like and do a 60-40 split or a 70-30 split if you’re feeling more aggressive in saving. And if you’re feeling extremely gung-ho in paying off some debt or would just like to maximize your savings so that you can invest the maximum amount, you could go all out and just not eat out for the entire month.

This blog is about *personal* finance, and as such, how you want to allocate your eat-out spending to your eat-in spending is entirely up to you.

Going on the same vein of personal finance – I personally live in New York City, so the differences in your eating out vs. eating in spending could vary. The important part is to do this analysis and then be able to see what would be the maximum money you’d be able to save per month if you only ate groceries you bought instead of eating out, so that you can build on that foundation to be able to make consistently good financial choices.

For example, if your maximum savings (100% groceries and eating in) is about $400/mo and you have a savings goal of $300/mo, then feel free to eat in just enough to save $300/mo. Conversely, if you could save $400/mo by eating 100% groceries but your savings goals is $500/mo, then you might want to cancel $100/mo in subscriptions to make up for that deficit.

Once you’ve nailed down the ratio of “eating out vs. eating in” that works for you, let’s get to saving even more by hacking our grocery spending.

5 Tactics You Have To Use To Save Money On Groceries

First, Buy In Bulk

This isn’t really a secret. But buying in bulk will save you a lot of money on groceries because stores selling their goods in bulk enjoy economies of scale. Sam’s Club and Costco are great resources for buying in bulk, and they provide premium foods at a much cheaper cost than you might get at a Kroger’s or Safeway.

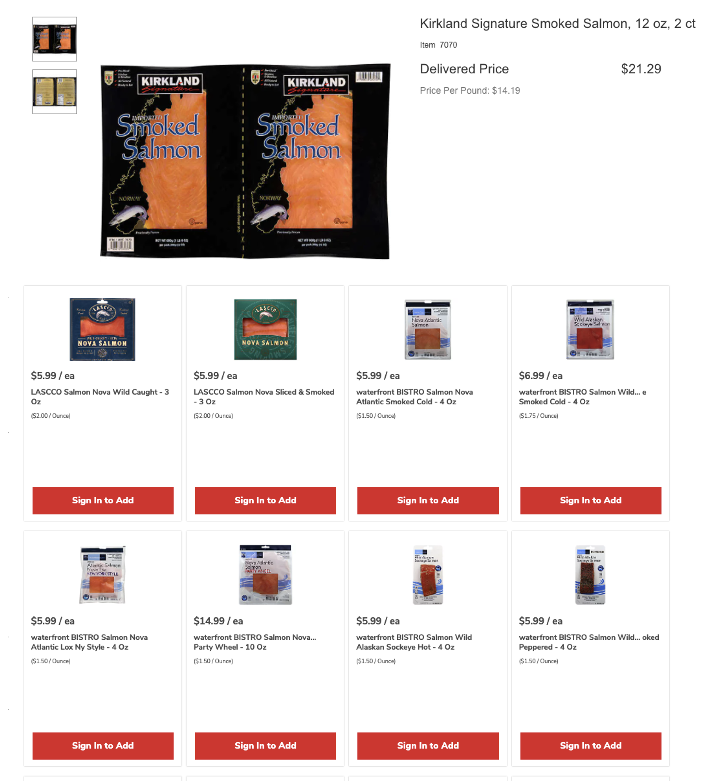

Here’s an example:

You’ll notice that Costco sells smoke salmon in such bulk that they price it as $14.19/lb. On the Safeway website, the cheapest smoked Salmon I could find is $1.50/oz, or $24/lb, or about 69% more expensive than Costco.

A Costco membership costs either $60 or $120 per year, with the latter giving you an extra 2% reward on qualifying Costco purchases (you’d break even at about $3000/yr at Costco to account for the difference in membership fees). Either option is a great way to go, and by buying bulk you’d easily make your money back.

OK, so what if you’re like me and live in Manhattan and there’s no Costco or Sam’s Club close by? You can buy in bulk, online, as outlined below.

Second, Buy In Bulk Online

There’s a couple of big options to buy cheap food in bulk online:

- Amazon Fresh

- InstaCart

Amazon Fresh: Depending on where you live, there could be a $35 to $50 minimum order limit in order to avoid the delivery costs. You should definitely order more than the minimum limit, because a $5 delivery cost on a $34.99 order would mean you’re spending roughly 14% extra for no reason.

The other thing to watch out for with Amazon Fresh is that they generally source their food from Whole Foods, which isn’t cheap for some foods when compared to bargain grocery stores. Surprisingly though, I find that a lot of foods are on par if not cheaper than Safeway and perhaps even Costco. There’s no “one size fits all” with Whole Foods, so be sure to price shop around for your most frequently purchased foods so you’re not paying a bunch of extra money for no reason.

Instacart: The main advantage Instacart has over Amazon Fresh is you get more variety. Even though Costco is very far away from me, Instacart can still deliver Costco groceries to me (amongst a bunch of other grocery chains). So if I end up wanting some foods from Costco, some from a Chinese supermarket, some from Sam’s Club, I can customize my order quite a bit.

There’s 2 things to watch out for here though:

First, each store generally has its own order minimum. So for example, if you wanted to get food from Costco and then a Chinese supermarket, you might need to satisfy a minimum order amount from both grocery stores before you can even place an order.

Second, Instacart comes with a subscription fee. As of this writing, Instacart costs $99 per year, or optionally $9.99 per month. There are other fees as well, as listed here: https://www.instacart.com/help/section/360007902791/360039164252

So the main tradeoff for Instacart is you have more food delivery options but you have to pay a premium for that flexibility.

Personally, I like the Amazon Fresh option since there are no extra fees tacked on top of it, which makes life simpler.

3-Day Freedom Challenge

Sign up for this 3-day challenge to automatically save & invest your way towards financial freedom!

Third, Go Buy Groceries In Person To Save More Money

This one is pretty straightforward: it will generally be cheaper when you shop in person than when you shop online. For example, Amazon Fresh hummus cost about $1 more than when I bought the same hummus at a local Whole Foods.

It makes sense that buying online would cost more because the delivery company needs to pay their employees to deliver their food to you, and they need to pay for vehicles, gas, insurance, and other operating costs. The premium you pay online helps pay for some of these.

The counterargument for this is that companies can rent out places in areas that are cheaper and then just deliver the food to you from a larger distance, saving out on rent. As far as I know though, there’s no such savings because Whole Foods as an example they pack online orders at their regular high-traffic grocery stores.

So, if you can, and if the gas cost and car wear and tear costs offset the premium you’d pay for your food online, this can be a good option as well.

Personally, I buy the bulk of my foods online for convenience and go in person to buy to fill in the gaps between shipments.

You can think of this lever as a tradeoff between 2 things: 1) how much money you want to save on your groceries and 2) how much “sweat equity” / manual labor you’re willing to do to buy food.

Fourth Tactic: Don’t Get Pre-Washed

Pre-washed foods cost more for 2 reasons: 1) it’s more work for them to wash your veggies for you, and 2) they can charge a premium for it due to the convenience it provides you for not washing your veggies.

I’d argue that it isn’t any more convenient because the way that the pre-washed veggies work can vary between vendors. Would you trust some stranger to wash away all the damaging pesticides from your vegetables? After all, it’s your health and if you build up chronic health issues from consuming too much pesticides over time, you wouldn’t even be able to sue anyone because there’s no single source to blame.

So even if something is pre-washed, I can’t really trust it and would need to do some extra washing myself anyway – which offsets the convenience factor of buying pre-washed.

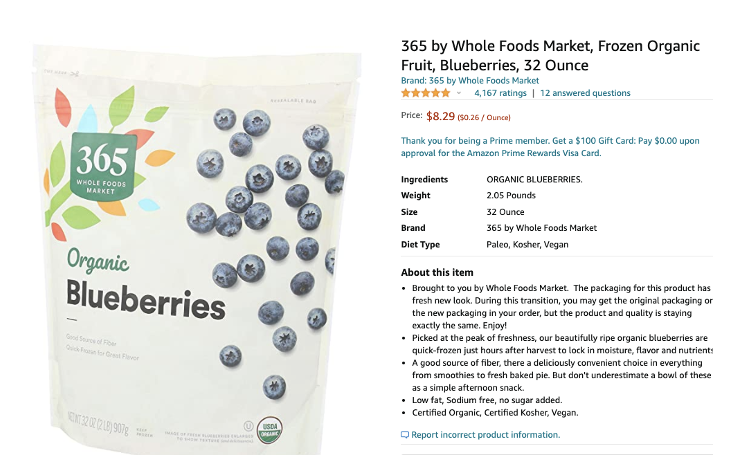

Finally, Get Frozen Foods

Frozen veggies fruits and veggies costs less, and is much easier to make smoothies with. Blueberries are fairly perishable and I’ve seen frozen blueberries cost $7 per pound. On Amazon Fresh, frozen organic blueberries could cost $4.15 per pound:

Since they’re already frozen, they’re super convenient to throw into a power smoothie with oat milk and yogurt for example.

3-Day Freedom Challenge

Sign up for this 3-day challenge to automatically save & invest your way towards financial freedom!

How Much Money You Want To Save On Groceries Is Up To You

Not eating out is a giant lever you can use to control your per-month expenses because food is one of the biggest variable expenses you could have each month.

In personal finance, there are no absolutes, and you should feel free to split up your “grocery” vs “eating out” ratio however you want. Just be sure to have the discipline to actually do the math so that the ratio you come up with makes sense! Don’t just blindly pick a number, because that defeats the entire purpose of thinking about your finances!

Save even more money by optimizing your groceries in the following ways:

- Buy in bulk for economies of scale

- Buy in bulk, online, if discount clubs like Costco or Sam’s Club isn’t easily available to you

- Buy groceries in person to avoid the premium of buying online if possible (the tradeoff here is gas fees and convenience).

- Don’t get pre-washed foods if you can – you never know how ‘pre-washed’ it is and it is impossible to verify, and it’s more expensive.

- Get frozen fruits and vegetables as they’re cheaper and they’re easy enough to toss in a smoothie or to do a simple stir fry.

Outside of food, there is one category that I can think of that’ll cost you lots of money, and that’s travel. This is where credit card points comes in, so be sure to check out our credit card-related posts to see how to use points to minimize your travel expenses!

P.S.: This is a new blog and if you’ve found this helpful at all, it would mean the world to me if you were to share this post to someone that you think this post might benefit. It would also be immensely helpful to me if you could give me any feedback on the content at hello@goodmoneygoodlife.com

0 Comments

Trackbacks/Pingbacks